Why does an excellent Va Affordability Calculator Change from a frequent Home loan Calculator?

- Financing Label. This is actually the time frame over that your mortgage becomes paid off, typically during the increments from fifteen or thirty years. It is impacted by even if you have got a fixed-rates name otherwise a varying-speed term (ARM). Smaller financing conditions mean that the borrowed funds becomes paid down reduced, while an extended loan name brings straight down monthly premiums.

- Army Type of. When trying to get a Virtual assistant loan, armed forces provider affiliates are required to bring a certificate away from Qualification (CEO) that reveals your entitlement updates into the Va loan program. Qualifications getting a great Virtual assistant mortgage depends on when you offered, the capability where you supported, therefore the cause of your own breakup or release.

- Army Disability. Being qualified to have an armed forces impairment on a great Virtual assistant financing causes certain tall deductions in the full loan amount. People who qualify aren’t needed to spend the money for Va investment percentage. While doing so, Va lenders can number impairment earnings as productive earnings on the a great financial

- Prior Virtual assistant loan Utilization. It is definitely you’ll be able to to track down an extra Virtual assistant financing if you really have currently used the entitlement program in earlier times. Virtual assistant home buyers should be aware the Va funding payment price try 2.30% for basic-go out Va financing individuals with no deposit. New funding commission increases to 3.60% for these credit another Virtual assistant financing.

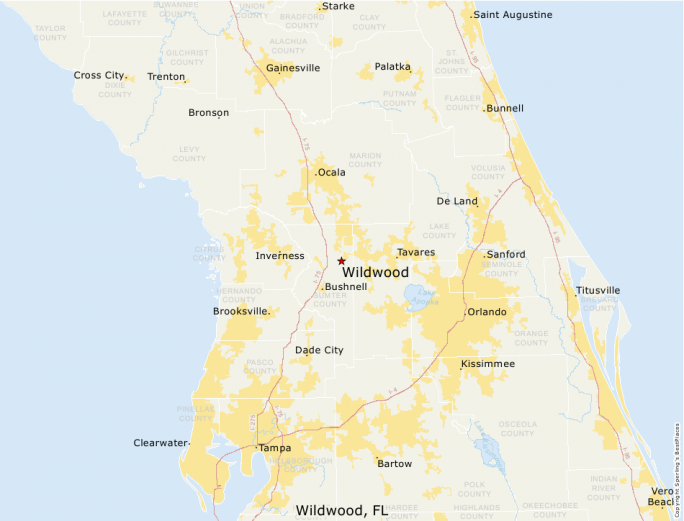

- Property Income tax Rates. It matter may vary because of the place, but normally drops as much as step one.2%. To acquire a specific quote, ask your financial so you can dictate your residence taxation matter.

- Home insurance. Injuries happen, which will be disastrous in essence emotionally and you will economically. Homeowner’s insurance will bring safeguards to possess loan providers and you will property owners though you to definitely like a major accident takes place. It varies because of the county as well as the form loans in Grimes of insurance coverage ordered, which have straight down constraints hovering doing 1% and you may higher limitations hanging up to six%.

Certainly there are many enters which get factored under consideration when deciding their monthly payments towards an effective Virtual assistant financing. An excellent Virtual assistant affordability calculator is definitely a helpful device inside the choosing a quotation of these costs as well as have will provide you with a notion of what things to look for when plunging to your an excellent financial plan of action.

There are also a number of ways that calculating affordability to the a Va financing differs from figuring cost into the conventional financing. For just one, within alot more good and lenient words, active-obligation and resigned armed forces service professionals, along with surviving spouses, are not expected to shell out personal financial insurance policies (PMI). PMI is typically required by lenders to possess borrowers who aren’t capable put down a down payment out of 20% or more for the a property in order to counterbalance the threat of the newest family consumer defaulting toward that loan.

How can The home Financing Expert help?

Champion Mortgage, The home Loan Expert’s Va Mortgage Program. All of our experts, armed forces provider members, in addition to their family are entitled to a trustworthy credit people who’ll meet them with the same level of appeal and you may perseverance they presented in their own solution requirements.

For the reason that The united states Agency off Veteran Factors promises you to definitely area of the mortgage becomes repaid due to government-recognized resource

Our streamlined underwriting processes may be able to performed in the-house, expediting paperwork and you can deleting some of the be concerned for the just what normally otherwise feel a good bureaucratic process. The face-to-face method try an expression in our custom reach when it involves permitting our army provider people and veterans carry out good economic strategy which can have them towards the household of their aspirations.

A value calculator is a wonderful cure for start the new homebuying processes, however, an expert financial can provide you with a great deal more appropriate information on how much house you really can afford. Contact us from the 800-991-6494 to speak with our amicable credit professionals otherwise get in touch with all of us through all of our software to begin with towards the road so you can homeownership now.

- Rate of interest. With regards to the financing term, credit history, and some other private economic activities, rates of interest towards the a Va loan currently slide inside a range of just one.875 to 2.75%.

Comments are closed

Sorry, but you cannot leave a comment for this post.