What’s Financial Underwriting and how Can it Works?

Home loan underwriting is an important part of the property to purchase process. It’s the process lenders used to see whether a potential debtor can also be safely be eligible for a loan and you will, if so, simply how much they should be able to use. The objective of financial underwriting is to try to make certain that individuals is responsible and you can qualified adequate to make their monthly obligations promptly. In this post, we’ll safety the basics of mortgage underwriting and explain its character in the home to find procedure.

Facts Home loan Underwriting

Home loan underwriting pertains to a lender evaluating a possible borrower’s income, assets, and you can credit score to decide once they is a good

An enthusiastic underwriter performs an important character at your home to purchase processes because of the examining an effective borrower’s finances and you will deciding even in the event it be eligible for financing. Essentially, lenders will at points for example money, credit score, property, debt-to-earnings ratio (DTI), and you will work background to assess even in the event a debtor is suitable for financing.

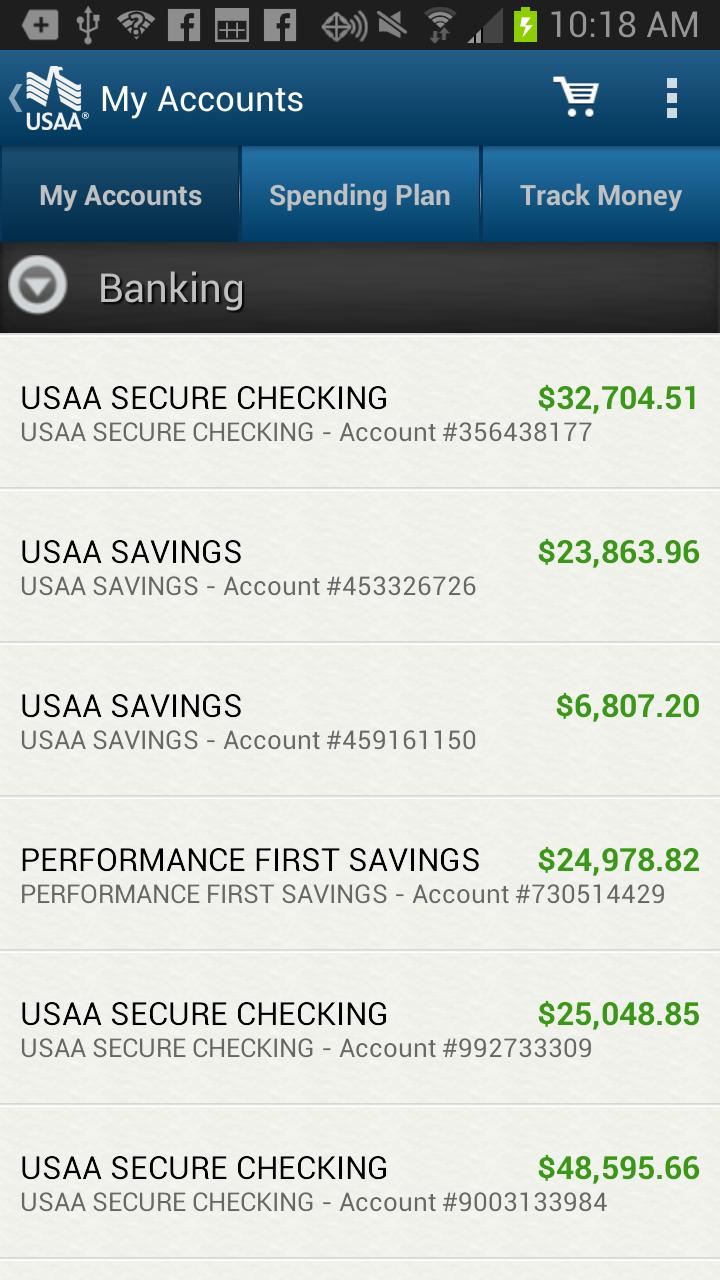

Whenever determining a possible borrower’s financial situation, a keen underwriter will comment data files like spend stubs, W2 variations, financial statements, taxation statements, and you may credit reports while making the best decision concerning the borrower’s capability to repay the mortgage.

As underwriter possess analyzed all of the expected documents and you may suggestions, they are going to suggest on the financial whether or not the debtor should be approved for a loan. The last decision sleeps to the financial, who will thought an underwriter’s recommendation before generally making its decision.

The loan Underwriting Procedure

Mortgage underwriting is an important help protecting home financing discover this info here. It will be the processes by which loan providers assess the risk of lending currency so you’re able to a potential homebuyer. Basically, underwriters evaluate whether you’re an effective applicant to have a mortgage mainly based on the financial history and you can most recent situation. There are two main primary brand of mortgage underwriting: manual and you can automated. One another provides pros and cons; wisdom these may make it easier to browse your house to purchase processes much more effortlessly.

Guide Underwriting

Guidelines underwriting is completed from the skilled underwriters whom carefully comment brand new borrower’s borrowing and monetary records information. Including contrasting the newest borrower’s credit history, money, payment records, or other associated financial pointers.

The strength of guide underwriting is dependent on its self-reliance. Underwriters takes a more nuanced view of an excellent borrower’s financial disease, considering things one to automated solutions you’ll overlook. By way of example, they might accept that loan for someone that have a low credit get but a powerful present payment background.

Although not, guidelines underwriting can be more date-ingesting whilst relies heavily on person intervention. In addition, it raises the possibility of subjectivity in the home loan underwriting processes, just like the more underwriters elizabeth pointers in another way.

Automatic Underwriting

Automatic underwriting, at the same time, utilizes app-motivated formulas to assess borrower analysis. These expert possibilities can certainly procedure huge amounts of mortgage applications, decision making swiftly and you will fairly with just minimal people intervention.

Automatic underwriting has numerous masters. Its timely, reputable, and you may able to handle a broad range of eligibility conditions. Additionally, it does away with possibility of people prejudice otherwise mistake when you look at the the fresh underwriting techniques.

Although not, its reliance on formulas function may possibly not capture the full picture of a good borrower’s financial predicament. Eg, an automatic program you will neglect anybody that have a somewhat lower income but good offers.

One another manual and you can automated underwriting methods gamble an integral role into the the mortgage application and you can approval processes. The option between them will relies on brand new borrower’s book financial situation and also the lender’s opportunities and you will procedures. Expertise such underwriting can also be enable you because a debtor, taking understanding of what to anticipate when applying for home financing.

Comments are closed

Sorry, but you cannot leave a comment for this post.