What exactly is an enthusiastic Amortization Schedule? Tips Estimate That have Algorithm

What’s a keen Amortization Agenda?

Amortizing loans element height commission amounts along side lifetime of new loan, but with varying size of attract and you may dominant making-up for each and every percentage. A vintage mortgage are a primary exemplory case of like a loan.

A loan amortization schedule is short for the whole dining table from periodic financing repayments, showing the amount of principal and payday loans Bridgeport you can attract define for each and every peak fee till the loan is actually reduced at the conclusion of their label. At the beginning of this new plan, most for every fee goes to focus; later regarding agenda, more for each fee starts to cover this new loan’s left dominating.

Secret Takeaways

- A loan amortization agenda was a desk that displays for every occasional financing fee which is owed, normally month-to-month, to have height-percentage funds.

- This new agenda breaks down simply how much of each and every commission is actually designated to the desire instead of the main.

- Loan amortization dining tables might help a debtor keep track of exactly what they are obligated to pay just in case percentage is due, and forecast the newest a fantastic harmony otherwise focus any kind of time point in this new stage.

- Financing amortization schedules are usually viewed whenever dealing with fees finance with understood rewards dates during the time the loan are taken out.

- Examples of amortizing funds is mortgage loans and you will car loans.

Understanding an Amortization Schedule

When you are taking right out a mortgage otherwise car loan, your own financial ought to provide you having a duplicate of the mortgage amortization schedule to discover at a glance precisely what the loan will cost and exactly how the main and you will focus is divided over their lives.

Into the that loan amortization schedule, the newest percentage of for every single percentage one to goes to interest diminishes a good part with every fee and the percentage one goes to dominating develops. Capture, such, a loan amortization plan to possess good $165,100, 30-season repaired-rates mortgage which have a beneficial cuatro.5% interest:

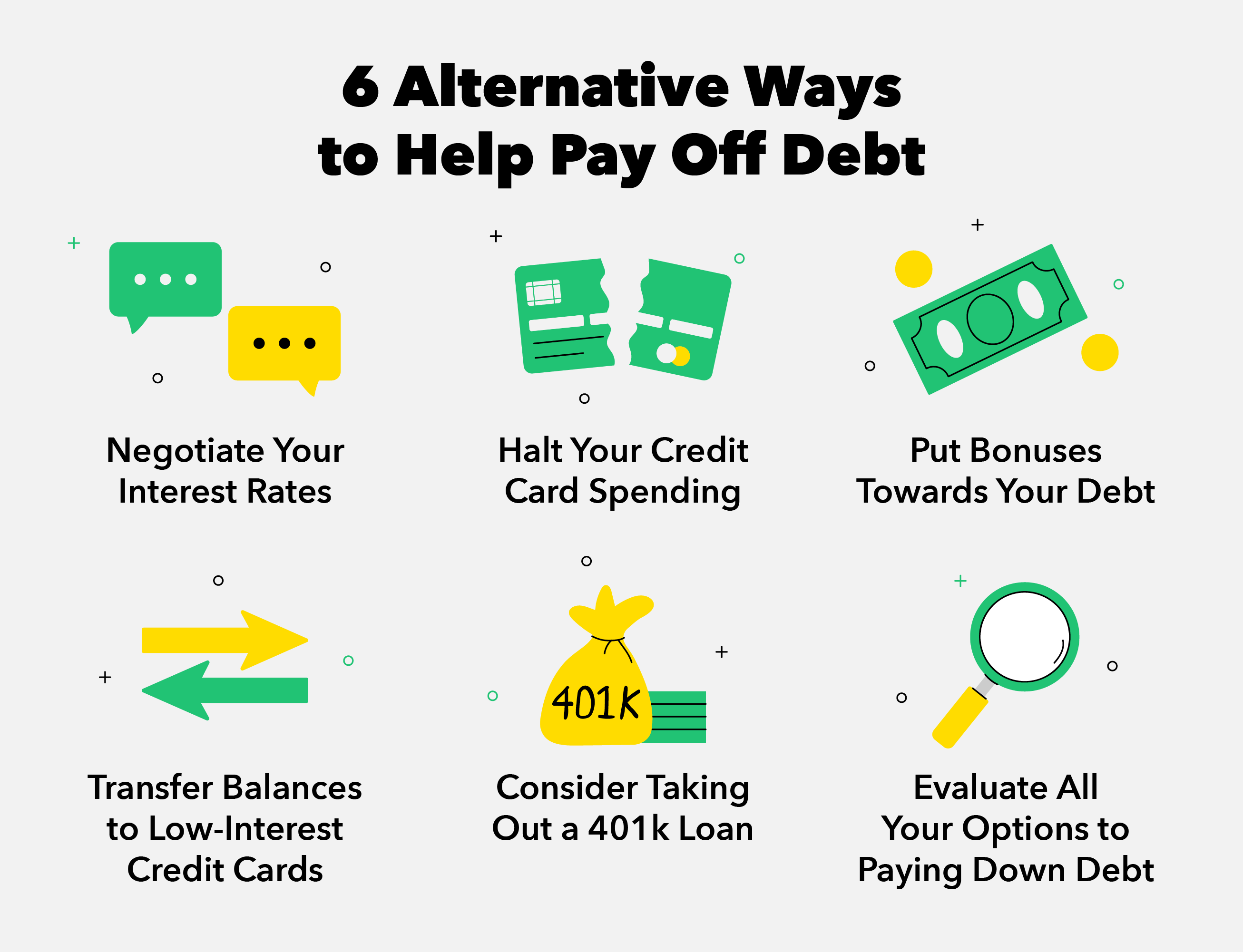

Amortization dates is going to be customized centered on the loan along with your personal activities. With an increase of higher level amortization hand calculators, like the templates you can find from inside the Excel you might compare just how while making expidited money can also be speed your amortization. In the event the eg, you are expecting a heredity, or you rating an appartment annual extra, you need to use these power tools examine just how implementing you to windfall on the loans make a difference to their loan’s maturity day and your appeal rates across the life of the borrowed funds.

Including mortgages, car and truck loans and private money are also amortizing to own a phrase invest get better, in the a predetermined rate of interest having a-flat payment. The fresh new terms and conditions are very different according to the investment. Really antique home loans are 15- otherwise 30-seasons terms. Car customers have a tendency to score a car loan which will be paid back more five years otherwise less. For personal money, three years is a very common label.

If you are searching to get financing, as well as playing with that loan amortization plan, you’ll be able to explore an enthusiastic amortization calculator so you can imagine your total financial costs predicated on your specific loan.

Algorithms Found in Amortization Dates

Individuals and you can lenders explore amortization schedules having fees money with benefits times which might be understood at that time the mortgage is applied for, for example a mortgage or an auto loan. There are specific formulas which can be always establish a loan amortization schedule. These algorithms tends to be integrated into the software program youre having fun with, or if you ortization schedule away from scratch.

If you know the phrase from financing in addition to overall unexpected fee number, there was an effective way to determine that loan amortization agenda versus turning to the application of an online amortization schedule or calculator. New formula to calculate this new monthly dominating owed to your an amortized loan can be as pursue:

Comments are closed

Sorry, but you cannot leave a comment for this post.