Things to consider whenever deciding locations to real time when you retire

One of the largest behavior you can easily build while the a good retiree was for which you need certainly to alive. Perchance you want to circulate nearer to grandchildren, live-in a retirement people or at least moving often free up some cash for the old age plans. Or perhaps we would like to buy a property that is most readily useful recommended for the retirement life.

Any type of your reasons, you ought to consider all your valuable housing alternatives and find the brand new one that is good for you. In many cases, http://www.availableloan.net/personal-loans-hi to shop for a pension house before you could retire could be your very best choice. For other people, renting could make the absolute most monetary feel. As well as particular, they will need home financing buying the new later years home of their aspirations. While addressing senior years or were there currently, it’s a lot of fun so you’re able to weighing advantages and you can disadvantages and you can find the casing option that’s right to you.

Thought using your coming plans and needs today can help you create a much better to buy decision. Here are a few facts to consider when considering pension property choices:

- What kind of existence would you like for the advancing years? Some individuals can not wait to participate an active retiree people in which they are able to work at its welfare. Other people crave a peaceful outlying lifestyle with their backyard. Or you imagine oneself travel the country and want a great low-fix family. Check out the lifetime we would like to take pleasure in while in the retirement very you may have a much better idea in regards to the sorts of housing you you prefer.

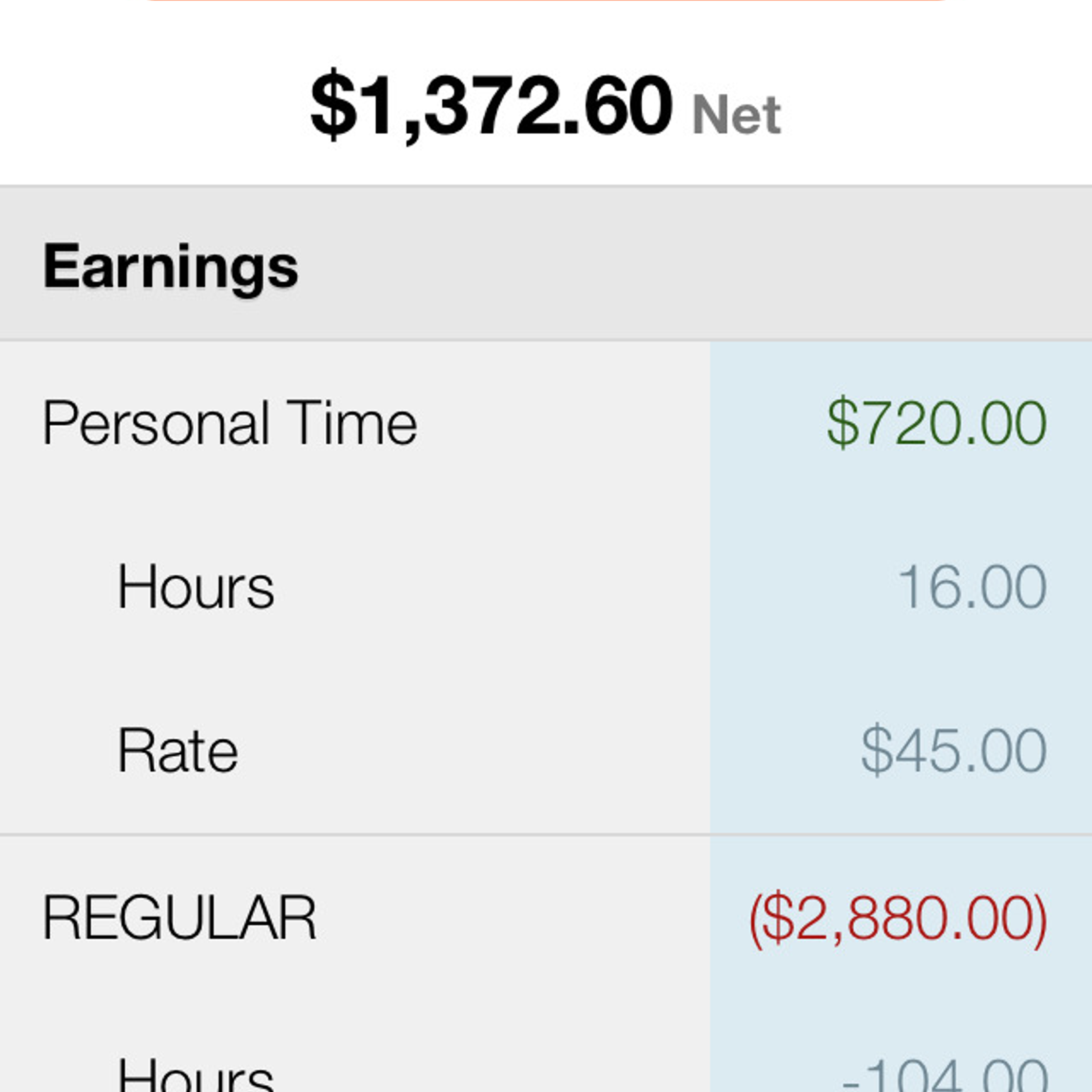

- Just what will your income get into later years? If you have currently resigned, you may have wise what your month-to-month money is. For many who haven’t resigned yet, you are able to chat to a monetary coach to determine the funds you could easily be prepared to draw in. This should help you regulate how much family you really can afford in the old-age. Even if you’re buying property outright, you’ll still have costs particularly fix, HOA charge, fees and you will insurance rates to fund.

- What proper care requires could you be planning enjoys later? You will never predict the long term with regards to your health. However, you should thought exactly how your position will get transform because you era. You may want to inhabit a house that fits the individuals need now or can be easily retrofitted if needed.

Houses alternatives just after old-age

After you have a crisper picture of each other the desires and you will requires on the retirement age, it is the right time to initiate provided where you must live. Retirees keeps a good amount of selection, most of the with regards to own advantages and disadvantages.

step one. Downsizing your home

For individuals who currently own a property, you could sell it to go towards the one thing less plus in balance. Downsizing could possibly get allow you to fool around with equity to get one thing faster high priced. You might fool around with people left money to boost retirement earnings. Downsizing can lessen their monthly obligations, too. it may allows you to choose a house that’s better suited to their modifying needs, such fewer steps or senior-amicable restrooms. Of these with lots of guarantee within their newest home, this is a good option.

- Pros: Can help you get paid from the security of your home to make use of with the a special house or even to boost your old-age income

- Cons: Tresses you on a home after you may wish a lot more liberty on the later years age

2. Remaining in your current household

We handling its later years ages want to ages in place because of the remaining in the current home and you will adjusting they on the needs as time goes by. This is exactly a great choice if you love your home. Additionally, you will learn your house’s restoration requirements and can arrange for them. Understand broadening fix costs as you get old, in the event. This includes retrofitting for your altering means and you will purchasing people to do the things might no lengthened have the ability to manage your self.

Comments are closed

Sorry, but you cannot leave a comment for this post.