seven.How often Really does Credit Karma Change Ratings?

Credit Karma updates all of the eight-months as well as the providers says with the ability to upgrade TransUnion credit ratings day-after-day. You can easily pick such transform on the internet site or during the software. Which isbeneficial to everyone, especiallyif you are dealing with an almost-name aim of obtaining a loan to buy property.

Their borrowing always is changing, regardless of the you do. For people who unlock another personal line of credit or improve your costs money, you will notice their credit ratings rise. But even though you don’t change your commission activities otherwise discover the brand new lines of credit, the fresh ratings often nonetheless transform.

As your credit lines get older, this may enjoys a confident effect. It does show that you’ve got more established credit lines. In the same manner, your credit rating can increase since the a single-date outstanding payment fades into history.

Of numerous loan providers will provide brand new recommendations in order to credit agencies monthly. Specific carry out weekly. So you could need certainly to watch for a small whileto look for high alter on get.

If you’re lookingfor yourdream homein the latest suburbs, you must know what your location is. Having the ability to look at the credit history any time is only help you achieve the amount you need.

8.Does Borrowing Karma Keep My personal Suggestions Secure?

Borrowing from the bank Karma should run Equifax and you can TransUnion to obtain your credit ratings. Speaking of a couple of chief credit agencies. For that reason, you’ll want to input particular information that is personal- however a lot of.

It is possible to input the label, birthday, target, additionally the last four digits of the personal coverage matter. For the infrequent cases, you may need to give your entire personal safeguards matter.

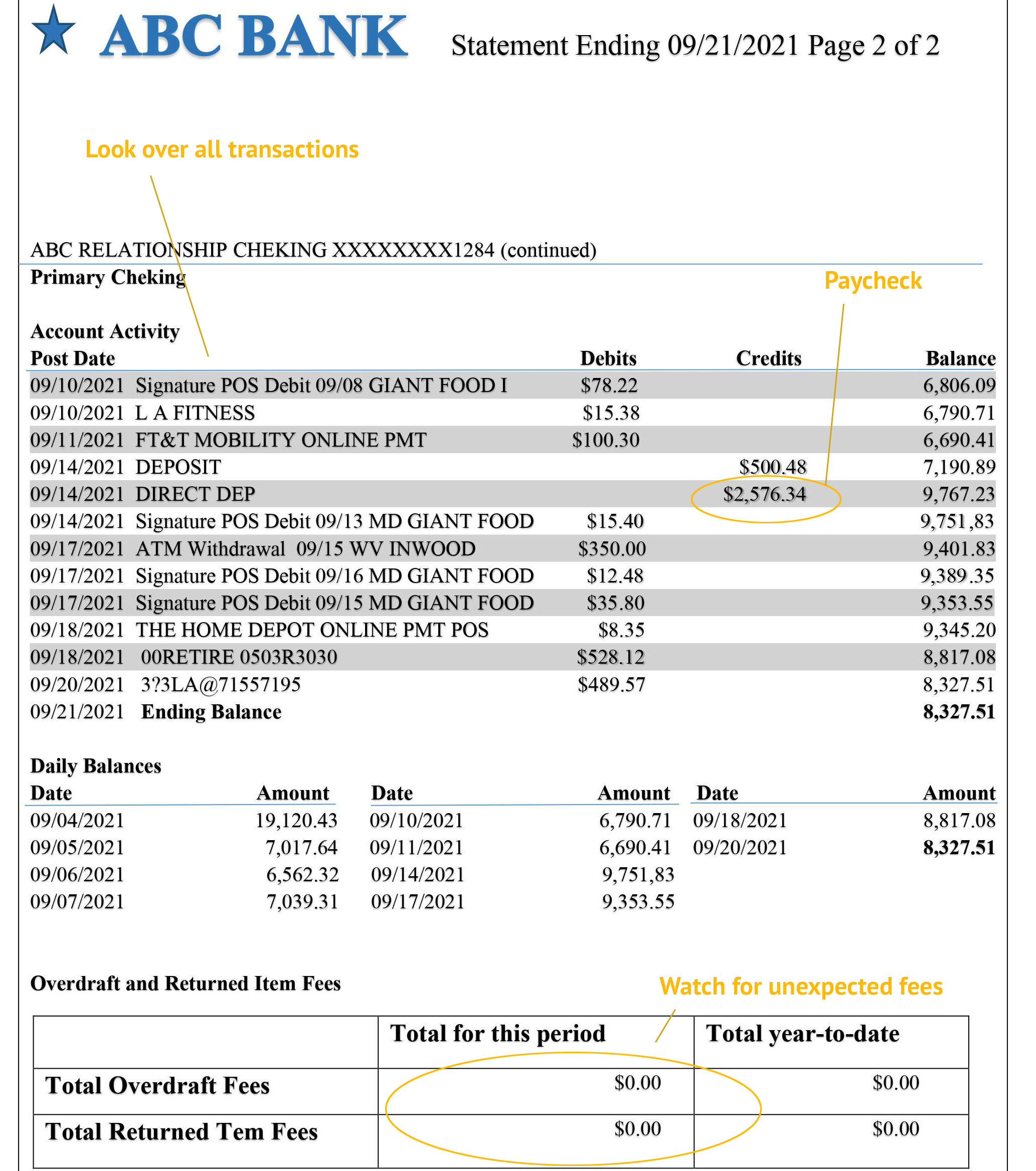

When you’re Credit Karma is also tune questions into the private information, its smart to be your own watchdog. If you get a credit file, look at they getting inaccuracies in your commission background, incorrect balance, otherwise account which you never ever written.

There is no doubt one to Borrowing from the bank Karma will not be getting your personal data available to choose from. Simply put, businesses won’t have use of it. The business makes a question of securing your own label regarding all risks.

In addition, Borrowing from the bank Karma uses new encoding and you will protection. So it keeps webpages hackers frombeing in a position to get your very own information.

9.What’s the Benefit of Borrowing Karma?

Among the larger perks from Credit Karma is actually the borrowing monitoring provider. This is very important given that you should understand how to display, boost and make use of your credit rating. A new shocking work with is the fact it helps protect against identity theft & fraud.

Because you can need flow rapidly to obtain recognized to own home financing, you want to know your credit score is stable. Which have credit keeping track of, Credit Karma will have a look at information online to find out if some one keeps broken a study.

The worst thing we should manage isidentity thieves. Id theft happens when people requires the personal safeguards amount. They might just be sure to unlock bank account or go shopping in the the label.

By monitoring your own credit, you might connect breaches ahead of it snowball on larger situations. A better credit file means lenders can offer finest attention rates towards the funds and lower fees. Also, you can keep your insurance premiums down when you yourself have a solid credit rating.

10. How many times Would you Check your installment loans Kansas Credit history?

Are you currently wanting to know if examining your credit score constantly are crappy? Luckily for us you to definitely youdon’tneed to consider which that have Borrowing from the bank Karma. You can examine often- as well as 100 % free- without creating disruption into score.

Borrowing from the bank Karma prompts the users to check on its credit history and if they would such as for instance. When you start to construct borrowing from the bank, that will motivate you to store moving in the best advice.

Comments are closed

Sorry, but you cannot leave a comment for this post.