Opposite home loan vs. cash-away refinance: That’s top?

Faced with highest will set you back ranging from fuel and you will food so you can credit credit and bills, of several People in the us are seeking a way to availableness additional money. To possess property owners which have large domestic security , a couple choices are entering new limelight: contrary mortgage loans and money-away refinances .

These types of funding choice could offer a beneficial lifeline so you can homeowners by allowing them to supply new guarantee within homes having funds to cover highest costs or manage unforeseen will set you back. However, they aren’t for everyone. Before you sign to the dotted range it can help for taking a nearer evaluate contrary mortgage loans in the place of cash-out refinances, how they work and you can which they might work with by far the most.

What’s a contrary mortgage?

A reverse financial is primarily readily available for elderly somebody during the old age who are in need of additional funds to deal with everyday costs who want to make use of its house’s well worth without the need to sell. As a result, it home loan allows homeowners aged 62 and elderly to view their house collateral.

However, as opposed to a classic financial in which you have to build month-to-month mortgage payments toward bank, a reverse home loan takes section of your home guarantee and you may transforms they to your cash to you. You could have the fund as a predetermined month-to-month earnings, a line of credit otherwise a lump sum.

Among the first benefits associated with a reverse home loan for older homeowners is you don’t need to pay-off the loan as long as you continue steadily to live-in the house. But not, you ought to pay back the mortgage for many who promote your residence, move out otherwise die. At that point, the loan must be paid back, which is aren’t carried out by offering the home.

If it could be better to open

An other home loan might be a good idea for residents without money had a need to be eligible for that loan demanding immediate payment, particularly a cash-out re-finance, household security mortgage or HELOC . Opposite mortgage loans is helpful if you have reasonable security of your house but need assistance to cover your everyday expenditures. You should buy the newest financial recovery you prefer from the comfort of your family.

«Here is the merely mortgage you could sign payday loans Jupiter up for for which you aren’t expected to create costs when you’re live and you can surviving in your house,» says Craig Garcia, chairman off Financial support Partners Home loan Qualities, LLC. «There isn’t any almost every other means to fix accomplish that. An opposite financial is not the cheapest currency you could use, however it is the sole currency you could borrow and you may pay off after when you promote otherwise die.»

Garcia adds: «You to interest are deferred indefinitely. You retain the brand new ownership of the property and additionally, resistant to the attitudes of a few.»

What is actually a profit-aside re-finance?

Instance an opposing home loan, a cash-aside refinance was a mortgage which enables one availability the house’s equity for the cash you need. Cash-aside refinances was a greatest financing option always pay high-notice loans, protection do it yourself plans otherwise financing high purchases.

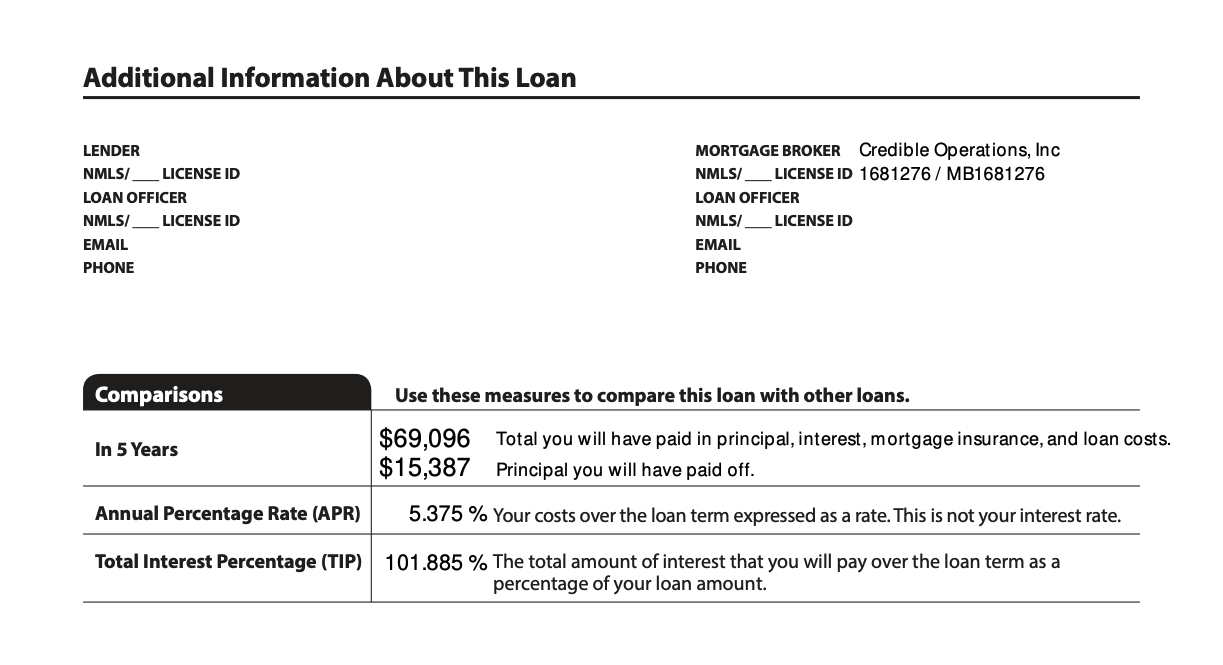

A funds-aside re-finance functions exchanging out your established mortgage which have an excellent larger one that could have another interest, fees label and month-to-month homeloan payment. Given that bucks-out refinance is for more income than just your existing equilibrium, you get to hold the difference in cash. Keep in mind, a bigger harmony will usually improve count you have to pay more big date, in the event the new financing sells a lesser interest rate.

You want substantial home equity getting eligible for a profit-away refinance, with many loan providers limiting your own borrowing limit in order to 80% of one’s home’s really worth. That it count is sold with your current loan’s harmony in addition to guarantee you need to utilize to own loans.

Comments are closed

Sorry, but you cannot leave a comment for this post.