One good way to recover Tsp fund if you are working is with Teaspoon finance

The newest Thrift Coupons Plan (TSP) is actually a life threatening part of a successful old age objective to own FERS retirees. Learning to accessibility their Teaspoon within the advancing years is vital, however you have an easy way to get the finance while working.

Prior to taking a teaspoon mortgage, the full impression of withdrawing advancing years money early should be thought about, because you will need to pay the borrowed funds having attention. Extenuating situations results in regarding necessity about how to dip into Teaspoon before getting advancing years.

The fresh legislation now discussed are general Tsp financing guidelines. The fresh CARES Operate of 2020 generated particular changes to opening the Tsp for it 12 months. Discover our CARES Operate blog site having basic facts.

Sort of Fund

The Teaspoon also provides two types of fund: residential and general purpose. Since the term ways, the fresh home-based mortgage can only be purchased with the pick or build out-of an initial household. A domestic financing cannot be accustomed re-finance a current home loan or for simply to make repairs so you’re able to an existing family. A residential mortgage possess a payment age of one to ten age and documentation needs.

The next brand of Teaspoon financing is actually an over-all objective mortgage that’s drawn for fool around with. In contrast to the new residential financing, an over-all objective loan does not require records features good cost chronilogical age of one 5 years.

It needs to be noted the smallest amount borrowed you might acquire are $step one,000 and you will only have you to general-purpose loan and you may one to residential financing a great meanwhile.

Who will Apply?

- Keeps about $step one,000 of benefits on your membership.

- Must be currently employed due to the fact a national civilian worker or representative of the uniformed characteristics

- Have not repaid a teaspoon loan (of the same type) in full within the past two months

- Haven’t got a taxable delivery with the that loan from inside the earlier 12 months, except if the new taxable withdrawals lead from your break up away from government service

Just how to Use

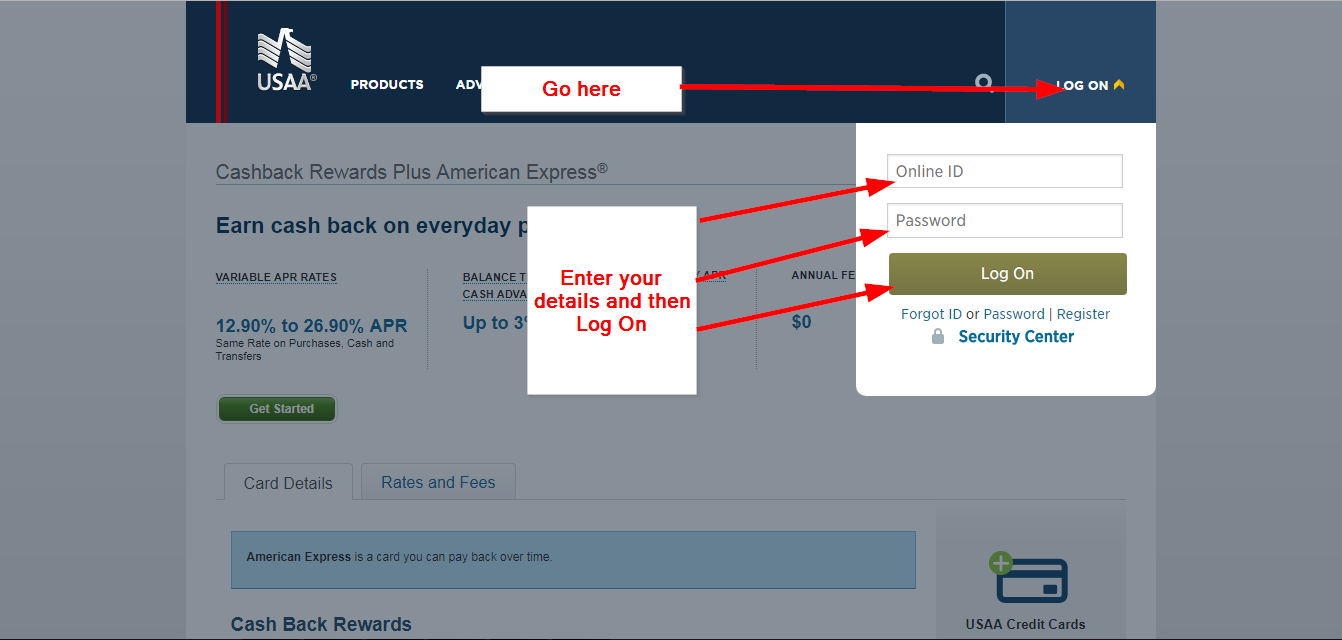

When trying to get an over-all goal loan, you should be in a position to complete the techniques entirely on the internet, until your situation suits one of many after the circumstances. When you are asking for money as a result of an electronic funds import or you are a wedded FERS or uniformed characteristics new member and do n’t have a medication Mode Teaspoon-16 with the file, then you’ll definitely have to print and fill in the borrowed funds arrangement getting processing. If finishing the program on the web or because of the printing it, step one https://paydayloancolorado.net/franktown/ would be to get on your bank account and you can start the process. You may complete Setting Tsp-20 and post or fax they in order to Teaspoon if you maybe not desire to fill out your details through the webpages.

The procedure to own requesting a residential loan is somewhat more as specific papers is needed. Understand the Money guide for much more about this procedure.

Lastly, it is critical to know that a teaspoon financing doesn’t have impact on taxation except if this is not paid down before senior years. Otherwise paid off, a tsp financing is managed once the a taxable delivery and you may influence your taxes.

Discover The options

Given that a federal employee, you have got a wide level of solutions. The brand new decisions you create if you find yourself performing-such as whether to grab a tsp financing-usually perception retirement. It’s essential to know about what your choices are and you may the potential effects of one’s measures.

Disclosure: All the information contained in such stuff should not be found in people real transaction without having any advice and information from an income tax otherwise monetary elite who’s always every relevant items. Everything consisted of here’s general in nature in fact it is maybe not implied because the legal, tax otherwise financing recommendations. Also, all the details consisted of here is almost certainly not relevant so you can otherwise compatible on individuals’ particular items otherwise means and may wanted said out of most other matters. RBI is not a brokerage-specialist, funding consultative firm, insurance provider, otherwise agencies and does not provide money otherwise insurance-relevant recommendations or recommendations. Brandon Christy, President away from RBI, is even president out of Christy Investment Government, Inc. (CCM), a subscribed financial support coach.

Comments are closed

Sorry, but you cannot leave a comment for this post.