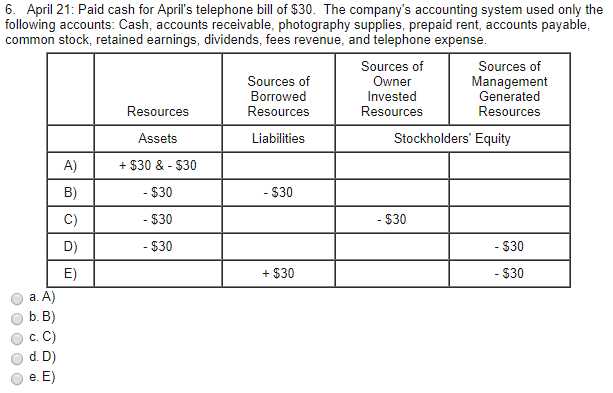

Journal Entry and Ledger Posting for Telephone Expenses incurred but not yet paid

But to understand the accounting process, let’s learn how to record the cash payment for telephone charges. When you receive the $20 from the employee, you will credit the account Receivable from Employees. Another common expense for business owners is the cost of paying employees. In this case, the total value of your payroll gets recorded in the payroll expense account. By crediting accounts payable, which is a liability account, this entry shows that you owe your vendor $1,000. In business, you record all transactions (including expenses) using a double-entry accounting system.

Summary of Paid Telephone Charges Journal Entry

You’d record the bill when you received it as an account payable, even though the final date for payment not fall due for another 15, 30 or 60 days. To record accrued interest expense, an adjusting entry debits notes payable for the amount of accrued interest, while a credit to accrued interest revenue is made on the income statement. A debit to interest expense and a credit to cash are also made simultaneously, as the accrued interest payable must be paid in cash. When the bill or invoice is paid, it will affect accounts payable and cash. Because you are reducing the liability of accounts payable, it is the debit side of the transaction.

Journal in Financial Accounting

Double-entry accounting is based on the premise that assets will always equal the liabilities plus the equity of the business. Assets may include cash and cash equivalents, buildings, equipment, investments and more. Liabilities are amounts your paid telephone bill journal entry business owes, such as balances with vendors, loan balances, revolving account balances and even settlement payments. The equity of the business is the difference between the assets and the liabilities and is affected by revenues and expenses.

Would you prefer to work with a financial professional remotely or in-person?

Businesses track their short-term debts as accounts payable in the general ledger, including the amount owing for their bills payable. Bills payable are the physical bills of sale that request payments by a certain date. In accrual accounting, revenues are matched to the expenses used to generate them, and are recorded when incurred regardless of when cash is exchanged.

What are the other considerations relating to the telephone expenses journal entry?

Bills payable are physical records of the amount owing for any products or services that a company buys on credit. Because of that, bills payable are sometimes called vendor invoices. Be sure to check your understanding of this lesson and the accounts payable journal entries by taking the quiz in the Test Yourself! Now when you have paid for the phone bill, you have given money for it, you decrease accounts payable and cash for 150. The bill will list the services used, the date of use, the duration of use, and the cost per unit for each service. It is important to review the bill carefully to ensure that it is accurate.

He is the sole author of all the materials on AccountingCoach.com. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Accounting is journaling the business transaction to determine a period’s profit or loss.

- For simplicity’s sake, also assume that the firm began operations on Monday 2 January 2017.

- The $1,000 credit to the cash account represents the money leaving your business’s bank account.

- The expenses are classified into direct expenses, indirect expenses, operating expenses, non-operating expenses, and more.

Let’s assume that an employee has made personal phone calls of $20 which are included in the company’s phone bill of $100. Below are two options for recording the cost of the employee’s personal phone calls. Paying employees is often one of the most significant expenses for small business owners. With Hourly payroll software, you can automatically run payroll and calculate related costs, like taxes and workers’ comp—all in one click.

If the company receives the invoice during the month, they have to include the expense in the current month. The expenses of a business should be recognized when they incur and not when cash is paid. The expenses are classified into direct expenses, indirect expenses, operating expenses, non-operating expenses, and more. The phone service provider usually sends the telephone bill to the company at the beginning of the month to charge for the previous month’s usage. While some services are able to send the statement at the month-end.

Telephone Charges are recorded by debiting the telephone expenses and crediting the Liability. If the company is able to receive the statement at the month-end, the accountant simply records telephone expenses and cash paid or accounts payable. The expense will be recorded directly into the month in which the service is used.

Comments are closed

Sorry, but you cannot leave a comment for this post.