Home Sellers Disappointed by Biden’s $10,000 Income tax Credit

In an effort to simplicity new casing market’s rigorous directory and you may help property owners looking to upgrade, Biden announced a proposal on the Thursday geared towards incentivizing brand new income away from beginning homes.

«To possess property owners shopping for a new set however, worried about giving upwards its down mortgage rates, I’m suggesting a beneficial $10,000 income tax borrowing from the bank once they offer their starter belongings,» Biden tweeted. This new step seeks and also make more house accessible to very first-time customers and allow newest residents to help you changeover to residences one «most readily useful match their requirements» on the $10,000 income tax borrowing helping to ease the economic strain.

But performing this manage see the citizen who’d the lower home loan speed in reality pay thousands of bucks more inside the attention than they’d has actually if they simply remained in this home. «I understand the fresh new purpose behind Biden’s suggestion, however frankly, the fresh new mathematics cannot make sense personally,» Kipp told Newsweek online installment loans Oregon via phone call towards the Monday afternoon.

Such, envision a homeowner whom took advantageous asset of the typical home loan rate away from 2.96 per cent in the 2021, protecting a 10 percent down payment to the an excellent $450,000 home with a 30-seasons fixed-speed home loan.

Alternatively, claim that same citizen sold their home, and you may purchased an equally listed family during the within most recent attention price out-of six.91 percent. The latest homeowner do deal with total payments out of $961,, that have interest amounting so you’re able to $556,.

The difference is clear. «Losing out on hundreds of thousands when you look at the attention savings having good $ten,000 income tax borrowing is simply not worth every penny,» Kipp said.

Going for Biden’s taxation borrowing from the bank and you can promoting your house to secure another type of home loan from the a higher level do bring about an more $339, during the appeal costs, far overshadowing the brand new offered $ten,000 incentive.

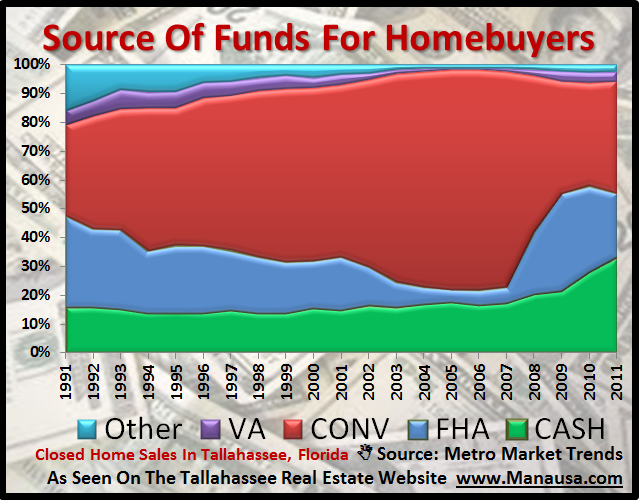

- Chart reveals where financial financial obligation is rising

- That condition helps you to save thousands to the possessions taxes

- Homebuyers may be obligated to shell out alot more once legal endeavor

- How Trump property seizures tend to impact The new York’s actual-property industry

Here is the «lock-in» impact, and you will depending on the Federal Housing Money Service (FHFA), what number of homeowners experience it is rising.

Over the longevity of the borrowed funds, they would shell out a maximum of $611,, along with desire out of $206

The end result, identified as a situation in which rising home loan prices discourage home owners out of promoting considering the prospect of forfeiting one to reduced-price financial getting significantly high cost, keeps real affects into houses freedom, field likewise have, and finally, household affordability, the newest FHFA said inside the research issued the 2009 month.

The newest statement found that several of productive mortgages from the U.S. is actually fixed-price, with most of the financing featuring interest levels most lower than current market prices. The new difference produces an effective disincentive to have selling, with respect to the agency’s results. «For each fee section one markets home loan cost meet or exceed the fresh origination rate of interest, the likelihood of deals decreases from the 18.1 percent.»

Thus, the lock-in essence possess resulted in a beneficial 57 per cent loss of house conversion process of fixed-price mortgages within the last one-fourth out of 2023 by yourself, according to FHFA, blocking more 1.step 3 million sales between your second quarter from 2022 and next one-fourth away from 2023.

The production constraint, powered from the resistance to sell, provides expensive home prices of the 5.seven %, the new FHFA told you, overshadowing the head effect regarding higher cost, which may generally speaking depress pricing.

Homeowners like MacKenzie Kipp which capitalized toward usually low financial costs in the pandemic carry out stand to dump a large amount of money lower than President Joe Biden’s advised $10,000 taxation credit to have attempting to sell its beginning property

Although not, there are buyers, despite higher prices and you can prices. History month’s current- domestic sales sprang because of the 9.5 %, establishing the largest monthly raise of present- domestic conversion during the per year, centered on a nationwide Organization out-of Realtors declaration issued Thursday.

Comments are closed

Sorry, but you cannot leave a comment for this post.