FHA fund is backed by the fresh Federal Property Management

Otherwise qualify for Va or USDA no down-payment lenders, there are many methods you can utilize to attenuate the off commission you might be expected to pay. You may look for assist courtesy certain deposit recommendations apps or of someone close.

FHA fund

It allow down money only 3.5% as well as have less strict credit conditions, leading them to recommended to have earliest-big date homebuyers or people with rugged borrowing histories.

This type of mortgage loans feature both an upfront financial cost out of step 1.75%, together with a yearly premium one equals ranging from 0.45% and you will step one.05% of your amount borrowed.

Conforming money

Mortgages one to adhere to Federal Homes Money Institution loan limits and the factors set by Federal national mortgage association and you can Freddie Mac computer is understood given that compliant money. Using these mortgages, one may get a house with only step 3% down.

In order to meet the requirements, you might have to end up being a primary-time homebuyer or meet earnings constraints for your urban area. Conforming finance also require a credit history of at least 620 and you can, if you make a downpayment off lower than 20%, you I).

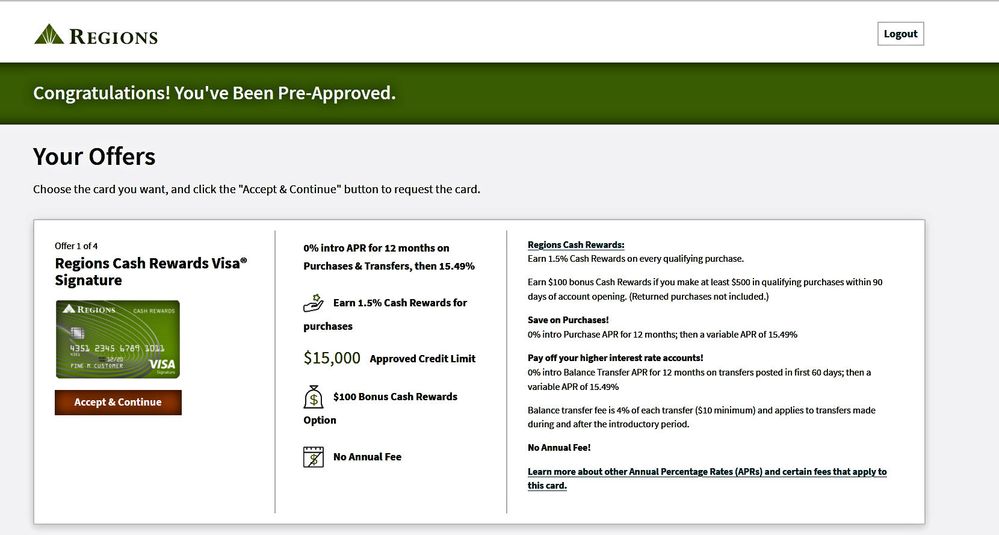

Lender-certain financing programs

Such are very different commonly, so be sure to research rates and you may contrast several options in the event the that is anything you’re looking for. You can search in order to financial institutions, credit unions, home loan organizations, and online loan providers to possess choice.

First-day homebuyer gives and you will advice applications

Towns and cities, condition property agencies, and you will local nonprofits often render advice apps that will help shelter the costs of the downpayment or settlement costs.

These may are in the type of offers, and that won’t need to getting paid, otherwise lower-desire fund, that you’ll slowly repay over the years. Occasionally, these types of loans can be forgivable if you inhabit our home for a particular amount of time.

Finding your way through the program procedure

To be certain you be eligible for a zero downpayment mortgage, work at getting the credit rating from inside the good place. If it is underneath the 620 in order to 640 draw, you might pay down your debts, disagreement errors on the credit file, otherwise ask for a credit line boost to alter the rating. Purchasing your debts promptly support, too.

Its also wise to decrease your loans-to-money ratio — or even the express of income the overall monthly personal debt repayments take. This is going to make you much safer to loan providers (you may have a lot fewer obligations and will also be expected to make your payments) and can even help you meet the requirements.

In the long run, collect up your economic records, including your W-2s, spend stubs, bank statements, and you may earlier tax statements. The lender will demand these to determine what you could be considered to have.

you won’t need a down payment having USDA and you may Va fund, they won’t been free of charge. One another finance wanted initial charge (capital costs having Va fund and you will be sure charge having USDA loans). These try to be financial insurance policies and you can cover their bank for folks who you should never make your costs.

You could also score increased rate of interest when forgoing a beneficial down-payment. This might raise each other their payment per month and your enough time-name focus costs significantly. Make sure that you adjusted your budget for these extra can cost you whenever going for one of these money.

Frequently asked questions

Yes, specific regulators-recognized mortgage programs succeed eligible individuals discover a mortgage in place of a down-payment, whether or not most other will cost you like settlement costs and higher rates of interest s that require very small off repayments (as little as step 3%, in many cases) https://paydayloancolorado.net/elizabeth/.

Va and USDA loans may be the head zero down-payment options in the us. The newest Virtual assistant loan program is just to possess army veterans, productive solution professionals, and pick partners, plus the USDA loan program is for include in particular outlying and suburban section.

Comments are closed

Sorry, but you cannot leave a comment for this post.