Dollar-Value LIFO Method What is It, Examples, Calculation

Consequently, the cost of goods sold (COGS) reported is higher, and the company’s taxable income is lower than what it would have been with FIFO (First-in, First-out). Dollar-value LIFO is an accounting method utilized for inventory that follows the last-in-first-out model. Dollar-value LIFO involves this approach with all figures in dollar amounts, as opposed to in inventory units. It gives an alternate perspective on the balance sheet than other accounting methods, for example, first-in-first-out (FIFO). Remember, this is a simplified example and doesn’t take into account some of the complexities that can arise when you have multiple inventory pools or when prices decrease.

- This approach is not commonly used to derive inventory valuations, for several reasons.

- Dollar Value LIFO is a method used in inventory management to evaluate the worth of goods sold and inventory, considering inflation and the changing value of money over time.

- The base year is the year from which the Dollar Value LIFO calculations start.

- The process of applying the Dollar Value LIFO method might seem overwhelming at first, particularly due to its distinctive steps.

- This change ensures that the indices used are relevant and accurately reflect market conditions, thereby providing a more reliable measure of inventory value.

LIFO Liquidation

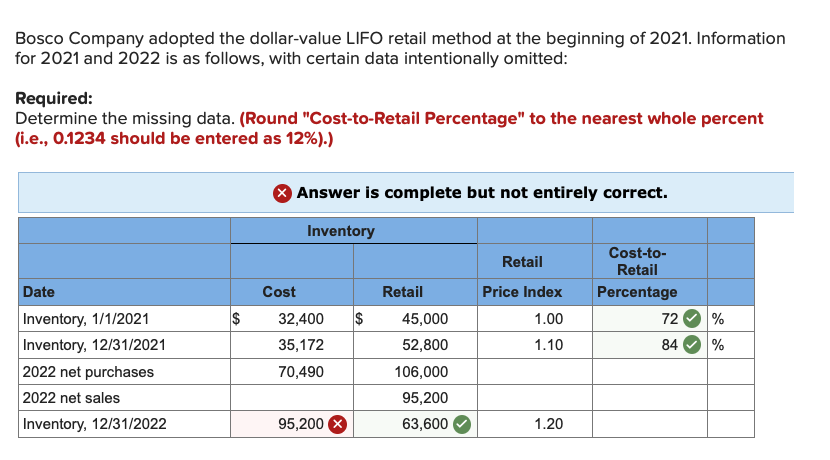

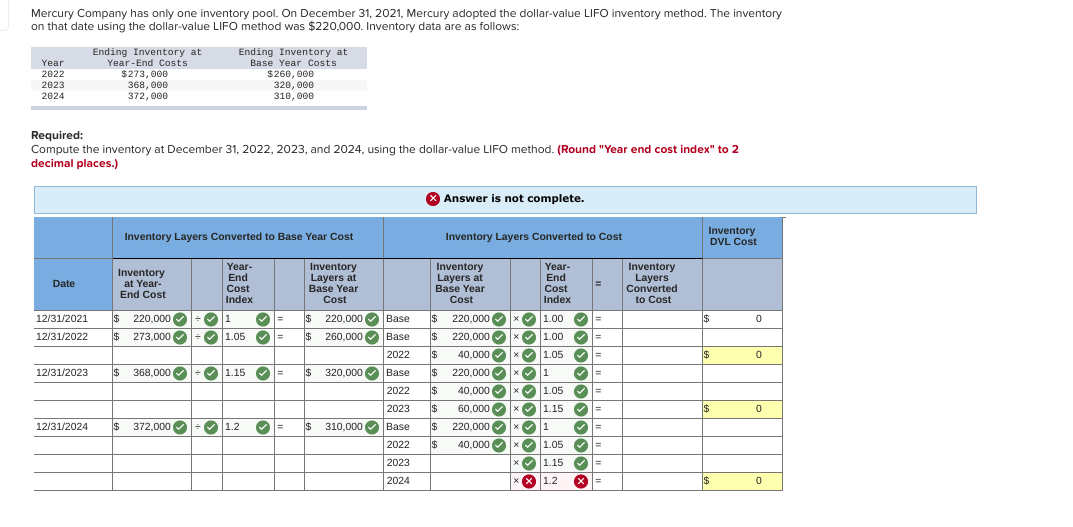

The DVL method allows you to determine the proper cost without referring to any flow assumptions for inventory units. In other words, you don’t have to worry about applying costs in LIFO sequence to the units you sell during the year. One thing worth mentioning again is that dollar-value LIFO pools the inventory up.

§474. Simplified dollar-value LIFO method for certain small businesses

The price index can be derived internally or obtained from external sources like the Consumer Price Index (CPI). By applying this index, companies can convert current-year inventory costs to base-year costs, allowing for a consistent comparison over time. Dollar-value LIFO is an accounting method used for inventory that follows the last-in-first-out model. Under regular LIFO, you can create pools of inventory, but each unit in the pool must be essentially identical to every other unit. If you sell or produce items that have annual model changes, you would have to create a new pool for each different model.

Comparison with Other Inventory Methods

The updated standards now mandate more rigorous documentation and justification for the chosen indices. This change ensures that the indices used are relevant and accurately reflect market conditions, thereby providing a more reliable measure of inventory value. It also reduces the risk of manipulation, ensuring that the financial statements present a true and fair view of the company’s financial position.

FIFO, for instance, is often praised for its simplicity and straightforward approach. By assuming that the oldest inventory items are sold first, FIFO typically results in lower COGS and higher net income during periods of rising prices. This can make a company appear more profitable in the short term, which may be appealing to investors. However, this also means higher tax liabilities, as the lower COGS increases taxable income. Dollar-value LIFO uses this approach with all figures in dollar amounts, rather than in inventory units. It provides a different view of the balance sheet than other accounting methods such as first-in-first-out (FIFO).

Understanding Dollar-Value LIFO is crucial because it offers unique advantages, particularly in periods of rising prices. It allows companies to match current costs with current revenues, providing a more accurate reflection of profitability. The pools created under this method are, therefore, known as dollar-value LIFO pools.

Adopting an example alongside theoretical learning aids in applying the steps involved in this method and visualising the actual working of the Dollar Value LIFO inventory management system. Therefore, let’s take a look at a comprehensive definition of adjusted gross income example of implementing the Dollar Value LIFO method and learn from it. The price index, which is the ratio of the price level of the current year to the price level of the base year, is utilised to achieve this conversion.

Repeat the entire process and you’ll find that a new LIFO layer of $100 is added. The inventory layers for 2020 and 2021 then become $0 and $100, respectively. The decision to use Dollar Value LIFO or any other inventory management method should be made considering a company’s specific circumstances and requirements. Just like any other inventory valuation method, the Dollar Value LIFO inventory method has its unique strengths and limitations, and it’s important to understand these.

Comments are closed

Sorry, but you cannot leave a comment for this post.