Delivering an opposite Financial and you can Delaying Public Coverage Advantages

Again, the fresh FHA assures HECMs. Lenders and you can personal loans Hudson WI no credit check brokers whom sell opposite mortgage loans sometimes high light that loan was federally insured, as if it insurance policy is mostly with the borrower’s cover. Yet not, it insurance system primarily experts the lender.

Tricky Adverts

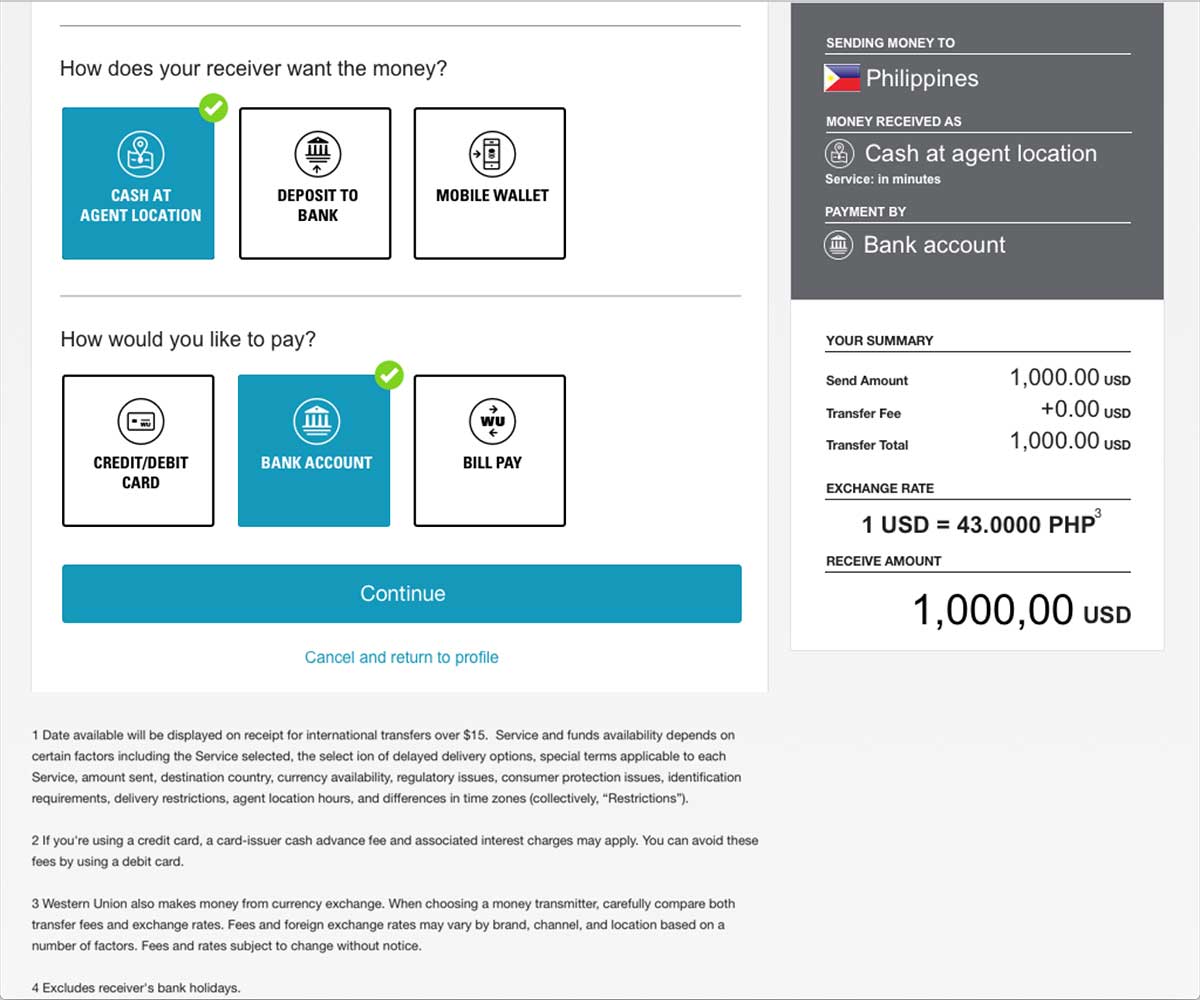

Certain adverts to own contrary mortgages state that you get «tax-totally free currency.» But of course, opposite mortgage continues aren’t taxed-a face-to-face home loan try a loan, maybe not money. Including, new advertisements constantly fails to reveal the brand new fees, criteria, or dangers of the loan. Will, seniors do not completely understand the newest regards to opposite mortgages, and inaccurate mailings merely worsen this dilemma.

FHA manages the latest advertising out of FHA-backed fund and has specific regulations to own contrary mortgages. Under FHA statutes, loan providers must define all criteria and features of the HECM system for the clear, uniform words in order to consumers. On top of other things, a lender has to disclose all following the.

- FHA guarantees fixed-rates and variable-speed opposite mortgage loans. Fixed-speed financing is actually delivered in a single lump sum no future draws. Adjustable-price opposite mortgage loans offer different payment choices and invite getting future draws.

- The age of the fresh new youngest debtor establishes the total amount you can rating which have an opposite mortgage.

- The quantity you can purchase from inside the earliest a dozen-week disbursement months is actually susceptible to a primary disbursement maximum.

Below FHA regulations, lenders cannot play with mistaken otherwise misrepresentative advertising or . Lenders may not believe that any one of items have been recommended of the FHA or HUD.

And additionally, a lender fundamentally is not allowed to have fun with FHA otherwise HUD company logos otherwise seals and other symbol you to imitates an official government secure with its adverts.

State Laws Sometimes Restricts Opposite Financial Ads

Certain claims, also North carolina, Tennessee, Oregon, and you can Nyc, impose some criteria and you may restrictions with the opposite mortgage adverts. (N.C. Gen. Stat. 53-270, Tenn. Password. 47-30-115, Otherwise. Rev. Stat. 86A.196, Nyc SB 4407). These types of statutes fundamentally exclude the lending company otherwise broker of misrepresenting situation activities or making not the case claims inside the product sales information getting reverse mortgage loans. However they constantly wanted particular disclosures regarding situation terms of this sort of financing.

Talk to a real house lawyer or a foreclosure attorney in order to know when your condition provides one regulations layer contrary mortgage loans.

Whilst not exactly a fraud, residents will be avoid taking right out an other financial so you’re able to slow down taking Social Cover experts.

Certain reverse mortgage brokers and you will loan providers recommend old people to find a face-to-face home loan and then make up the pit into the income when you find yourself postponing Social Safeguards pros until they are more mature. Once the Personal Shelter professionals is put off, the new homeowner becomes a long-term increase in this new monthly benefit whenever it start receiving gurus from the an older years.

However,, according to User Monetary Defense Agency (CFPB), the costs and you will risks of delivering a reverse home loan might be much more than the collective boost in Social Defense existence pros one to a citizen do located of the delaying Social Protection. For more information towards risks of acquiring an opposing home loan to help you slow down meeting Public Shelter, comprehend the CFPB’s statement.

Misrepresenting the risk of Dropping the house

Specific brokers improperly suggest that you will not remove your residence otherwise deal with property foreclosure by firmly taking out an opposite financial. Since discussed significantly more than, that it allege isn’t really genuine.

Access to Superstar Spokespeople

Reverse mortgage brokers will have fun with superstars for example Tom Selleck and Robert Wagner within advertisements. Although this isn’t necessarily a scam, the employment of star spokespeople is determined.

The fresh lender’s mission is to try to make us feel sure regarding the product. Because you trust the new representative, you might feel like you don’t need to learn the facts concerning financing. It is from the lender’s welfare on the best way to stay unaware. Once you understand all the standards and consequences regarding an opposing home loan, you would imagine double on obtaining one.

Comments are closed

Sorry, but you cannot leave a comment for this post.