Current Ratio Formula + Calculator

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Current liabilities are obligations that are to be settled within 1 year or the normal operating cycle. Current ratios can vary depending on industry, size of company, and economic conditions. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

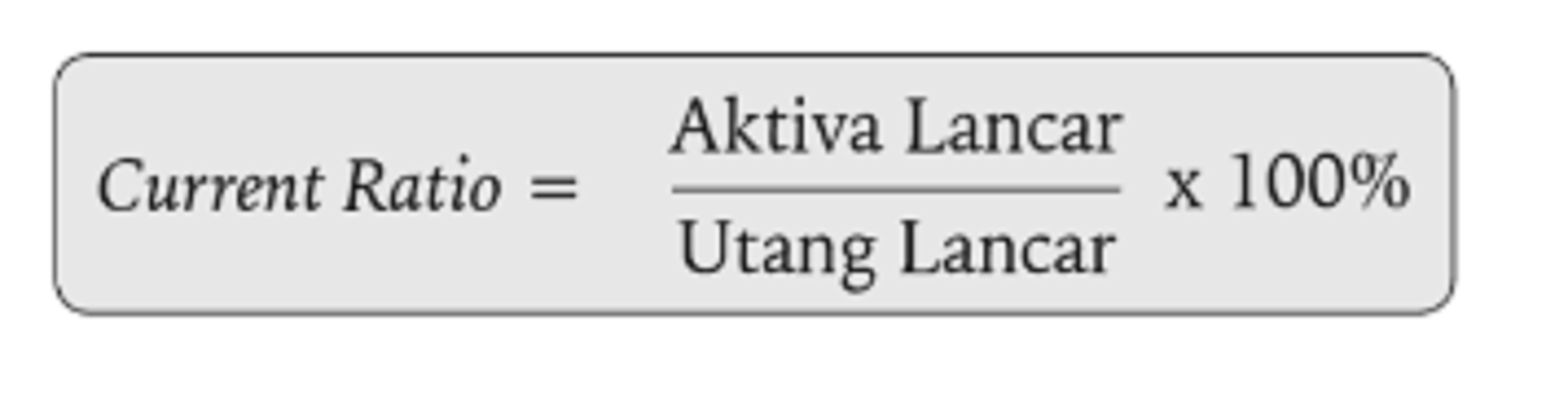

How Do You Calculate the Current Ratio?

The current ratio of such entities significantly alters as the volume and frequency of their trade move up and down. In short, these entities exhibit different current ratio number in different parts of qualified retirement plans vs nonqualified plans the year which puts both usability and reliability of the ratio in question. A higher current ratio indicates strong solvency position of the entity in question and is, therefore, considered better.

Create a Free Account and Ask Any Financial Question

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

What does the current ratio tell investors?

If a company has a current ratio of 100% or above, this means that it has positive working capital. The current ratio is a rough indicator of the degree of safety with which short-term credit may be extended to the business. On the other hand, the current liabilities are those that must be paid within the current year. The following data has been extracted from the financial statements of two companies – company A and company B. A current ratio of less than 1.00 may seem alarming, but a single ratio doesn’t always offer a complete picture of a company’s finances.

Ask Any Financial Question

While a high Current Ratio is generally positive, an excessively high ratio may indicate underutilized assets. It’s essential to consider industry norms and the company’s specific circumstances. For example, in some industries, like technology, companies may maintain lower Current Ratios as their assets are less liquid but still maintain financial health. The first way to express the current ratio is to express it as a proportion (i.e., current liabilities to current assets). In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position. An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio.

- This is why it is helpful to compare a company’s current ratio to those of similarly-sized businesses within the same industry.

- The current ratio is calculated simply by dividing current assets by current liabilities.

- If a company’s accounts receivables have significant value, this could give the organization a higher current ratio, which could in turn prove misleading.

- This is once again in line with the current ratio from 2021, indicating that the lower ratio of 2022 was a short-term phenomenon.

Current assets include cash, accounts receivable, inventory, and any other assets expected to be converted into cash within a year. Current liabilities, on the other hand, are debts and obligations due within the same timeframe. A current ratio of 1.5 would indicate that the company has $1.50 of current assets for every $1 of current liabilities. For example, suppose a company’s current assets consist of $50,000 in cash plus $100,000 in accounts receivable. Its current liabilities, meanwhile, consist of $100,000 in accounts payable.

The current ratio, in particular, is one way to evaluate a company’s liquidity, specifically the ease with which they can cover their short-term obligations. However, it is not the only ratio an interested party can use to evaluate corporate liquidity. Another factor that may influence what constitutes a «good» current ratio is who is asking. A lower quick ratio could mean that you’re having liquidity problems, but it could just as easily mean that you’re good at collecting accounts receivable quickly.

Working Capital is the difference between current assets and current liabilities. A business’ liquidity is determined by the level of cash, marketable securities, Accounts Receivable, and other liquid assets that are easily converted into cash. The more liquid a company’s balance sheet is, the greater its Working Capital (and therefore its ability to maneuver in times of crisis). Comparing the Current Ratio with other liquidity ratios, like the Quick Ratio or the Cash Ratio, can offer a more nuanced view of a company’s financial health. The Quick Ratio, for example, excludes inventory from current assets, providing a more conservative measure of liquidity.

Both circumstances could reduce the current ratio at least temporarily. The current ratio is part of what you need to understand when investing in individual stocks, but those investing in mutual funds or exchange-trade funds needn’t worry about it. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. In actual practice, the current ratio tends to vary by the type and nature of the business. Everything is relative in the financial world, and there are no absolute norms.

An excessively high current ratio, above 3, could indicate that the company can pay its existing debts three times. It could also be a sign that the company isn’t effectively managing its funds. When you calculate a company’s current ratio, the resulting number determines whether it’s a good investment.

Comments are closed

Sorry, but you cannot leave a comment for this post.