Current Ratio Definition, Formula, and Calculation

It suggests that the company can comfortably cover its current obligations. The current ratio is an evaluation of a company’s short-term liquidity. In simplest terms, it measures the amount of cash available relative to its liabilities.

The five major types of current assets are:

As with many other financial metrics, the ideal current ratio will vary depending on the industry, operating model, and business processes of the company in question. These are future expenses that have been paid in advance that haven’t yet been used up or expired. Generally, prepaid expenses that will be used up within one year are initially reported on the balance sheet as a current asset. As the amount expires, the current asset is reduced and the amount of the reduction is reported as an expense on the income statement. The current ratio also sheds light on the overall debt burden of the company.

Advanced ratios

In the first case, the trend of the current ratio over time would be expected to harm the company’s valuation. Meanwhile, an improving current ratio could indicate an opportunity to invest in an undervalued stock amid a turnaround. Changes in the current ratio over time can often offer a clearer picture of a company’s finances. A company that seems to have an acceptable current ratio could be trending toward a situation in which it will struggle to pay its bills. Conversely, a company that may appear to be struggling now could be making good progress toward a healthier current ratio.

Current vs. quick ratio

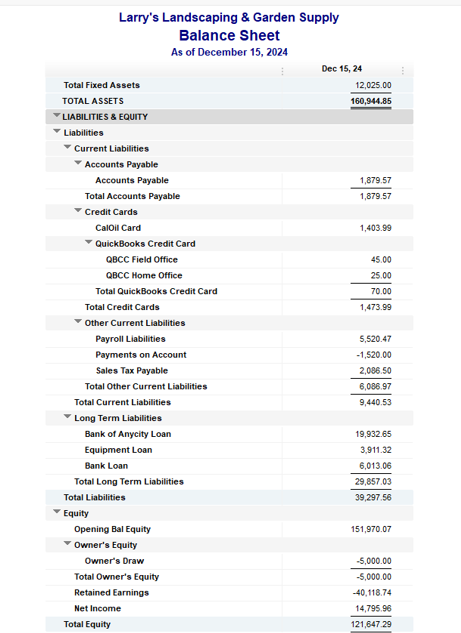

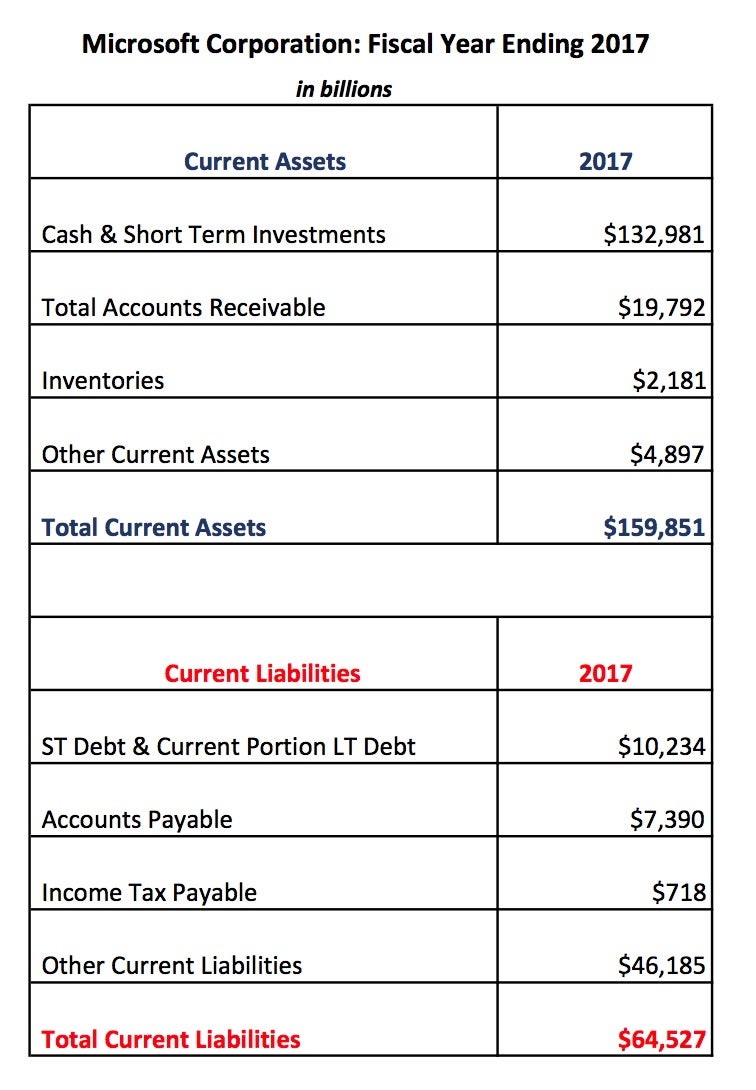

For the last step, we’ll divide the current assets by the current liabilities. Industries with predictable, recurring revenue, such as consumer goods, often have lower current ratios while cyclical industries, such as construction, have high current ratios. Even within an industry, current ratios can differ between companies. In some cases, companies may attempt to improve their Current Ratio by delaying payments or accelerating the collection of accounts receivable.

Sometimes, even though the current ratio is less than one, the company may still be able to meet its obligations. You have to know that acceptable current ratios vary from industry to industry. The value of current assets in the restaurant’s balance sheet is $40,000, nba 2021 luxury tax tracker and the current liabilities are $200,000. It can include patents, production equipment, inventories, etc. It can be trade debts, workers’ wages, taxes, and dividends. The current ones mean they can become cash or be paid in less than a year, respectively.

If it’s growing, that can tell investors and traders that the company’s current assets are growing. When you do that, you see that liquidity ratios are based on a borrower’s ability to pay off its short-term (or current) debt with its current assets. The current ratio is one of the most common measures of liquidity. It refers to the ratio of current assets to current liabilities.

- It’s limited to only current debt and asset and short-term needs.

- Its decreasing value over time may be one of the first signs of the company’s financial troubles (insolvency).

- The current ratio is a rough indicator of the degree of safety with which short-term credit may be extended to the business.

- It measures how much creditors have provided in financing a company compared to shareholders and is used by investors as a measure of stability.

In short, these entities exhibit different current ratio number in different parts of the year which puts both usability and reliability of the ratio in question. A higher current ratio indicates strong solvency position of the entity in question and is, therefore, considered better. Very often, people think that the higher the current ratio, the better. This is based on the simple reasoning that a higher current ratio means the company is more solvent and can meet its obligations more easily.

A disproportionately high current ratio may point out that the company uses its current assets inefficiently or doesn’t use the opportunities to gain capital from external short-term financing sources. If so, we could expect a considerable drawdown in future earnings reports (check the maximum drawdown calculator for more details). The company has just enough current assets to pay off its liabilities on its balance sheet. Current ratios are not always a good snapshot of company liquidity because they assume that all inventory and assets can be immediately converted to cash.

It could be a sign that the company is taking on too much debt or that its cash balance is being depleted, either of which could be a solvency issue if the trend worsens. Public companies don’t report their current ratio, though all the information needed to calculate the ratio is contained in the company’s financial statements. If a business’s short-term debt makes its acid test ratio look bad, it should consider refinancing it into longer-term debt. While this shift won’t make the debt disappear, it will give the business more breathing room to handle liabilities over a longer period, improving its short-term liquidity. A high ratio can indicate that the company is not effectively utilizing its assets.

We do not include the universe of companies or financial offers that may be available to you. You can find them on your company’s balance sheet, alongside all of your other liabilities. The current ratio is most useful when measured over time, compared against a competitor, or compared against a benchmark. While many consider a ratio of more than one a generally positive sign, what companies actually feel is a “good” ratio depends on their industry. For example, if the business is in retail or manufacturing, it will carry a lot of inventory.

The cash asset ratio, or cash ratio, also is similar to the current ratio, but it only compares a company’s marketable securities and cash to its current liabilities. Comparing the Current Ratio with other liquidity ratios, like the Quick Ratio or the Cash Ratio, can offer a more nuanced view of a company’s financial health. The Quick Ratio, for example, excludes inventory from current assets, providing a more conservative measure of liquidity. By examining multiple liquidity ratios, investors and analysts can gain a more complete understanding of a company’s short-term financial health. Working Capital is the difference between current assets and current liabilities. A business’ liquidity is determined by the level of cash, marketable securities, Accounts Receivable, and other liquid assets that are easily converted into cash.

Comments are closed

Sorry, but you cannot leave a comment for this post.