cuatro. Investigating Borrowing from the bank Conditions having Home loan Acceptance just after Property foreclosure

C. Obtain secured credit: Secured credit cards or money backed by collateral can be a useful tool in rebuilding your credit. By making timely payments, you can gradually change your credit history.

Research study: Sarah, a resident which knowledgeable foreclosures three years in the past, concerned about reconstructing their particular credit rating

John and you will Sarah confronted foreclosures on the house after a great a number of sad occurrences. Because of this, their credit scores plummeted, and battled to help you safer any kind off borrowing. Determined to reconstruct its credit and you can win back financial stability, they observed a disciplined strategy. They composed a budget, paid all their expenses punctually, and you can received a protected mastercard. Over the years, their credit ratings gradually improved, helping these to secure a mortgage and purchase an alternate domestic.

Credit history plays a crucial role in foreclosure situations. While the initial impact on your credit score can be significant, with perseverance and strategic financial believe, you can rebuild your credit and work towards a fresh start. Remember, each individual’s situation is unique, so it’s essential to seek professional advice and tailor your approach accordingly.

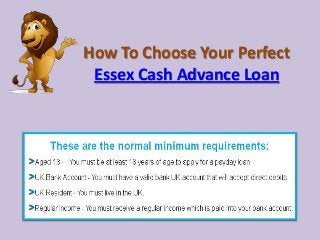

After going through the challenging experience of a foreclosure, many individuals may feel discouraged when it comes to obtaining a mortgage in the future. However, it’s important to remember that a foreclosure does not permanently ruin your chances of homeownership. Lenders have specific credit criteria that they use to evaluate mortgage applications after a foreclosure, and understanding these criteria can greatly increase your chances of getting approved. In this section, we will explore the key factors that lenders consider, along with some information and you may case training to help you navigate through the credit criteria.

One of the most crucial aspects of mortgage approval after foreclosure is rebuilding your credit score. Your credit score is a reflection of your creditworthiness and plays a significant role in determining whether lenders will approve your mortgage application. To improve your credit score, start by paying all your bills on time and in full. Consider obtaining a secured credit card, which requires a cash deposit as collateral, to help establish a positive payment history payday loan Inverness. Over time, in control credit management will gradually raise your credit score and demonstrate your ability to handle debt responsibly.

She vigilantly paid all the her debts timely, obtained a protected charge card, and you can left her borrowing from the bank application lower. Because of this, their credit history enhanced notably, and you may she was able to safer a home loan that have beneficial terms.

D. Screen The Credit: Frequently keeping track of your credit score enables you to pick any problems otherwise discrepancies which is often adversely impacting your own borrowing

Lenders usually enforce prepared periods shortly after a foreclosure before offered an excellent financial app. These types of prepared symptoms differ according to the kind of loan and this new points surrounding the newest foreclosure. Such as for instance, traditional fund fundamentally want good 7-year wishing months, whenever you are FHA fund might have a shorter prepared period of step 3 years. Its essential to become familiar with this type of waiting attacks and make certain you have the mandatory documents to support the job, such as for instance proof of earnings, taxation statements, and you can bank comments.

Tip: Keep all your monetary documents organized and you will easily accessible. With these records available often improve the application techniques and you may demonstrated their readiness to take on an alternative financial sensibly.

Loan providers should guarantee that consumers possess steady a career and you can an effective regular revenue stream to help with their mortgage payments. Keeping a stable jobs records and you will uniform money is extremely important when applying for a home loan once property foreclosure. Loan providers generally come across no less than 24 months from consistent a position and you may earnings. If you have has just altered services, make an effort to offer even more papers, such as give characters otherwise work contracts, so you can show their balance.

Comments are closed

Sorry, but you cannot leave a comment for this post.