Cost of a little house: The conclusion

How exactly to loans a small domestic

You may find it strange that it could be easier to rating home financing toward a manufactured home (on the tires) than just an usually mainly based smaller household. Perhaps mortgage companies haven’t yet cottoned onto the small family way, which is newer compared to interest in manufactured belongings.

Generally situated lightweight family

You will likely battle to score a mortgage to possess good little home. Of several loan providers lay at least well worth on funds they give you and can even enforce the very least square footage. Unfortuitously, smaller property usually flunk of both men and women thresholds.

Without a doubt, that does not mean you can not funds a little home. But you’ll need to take on options in order to a mortgage. Those individuals is:

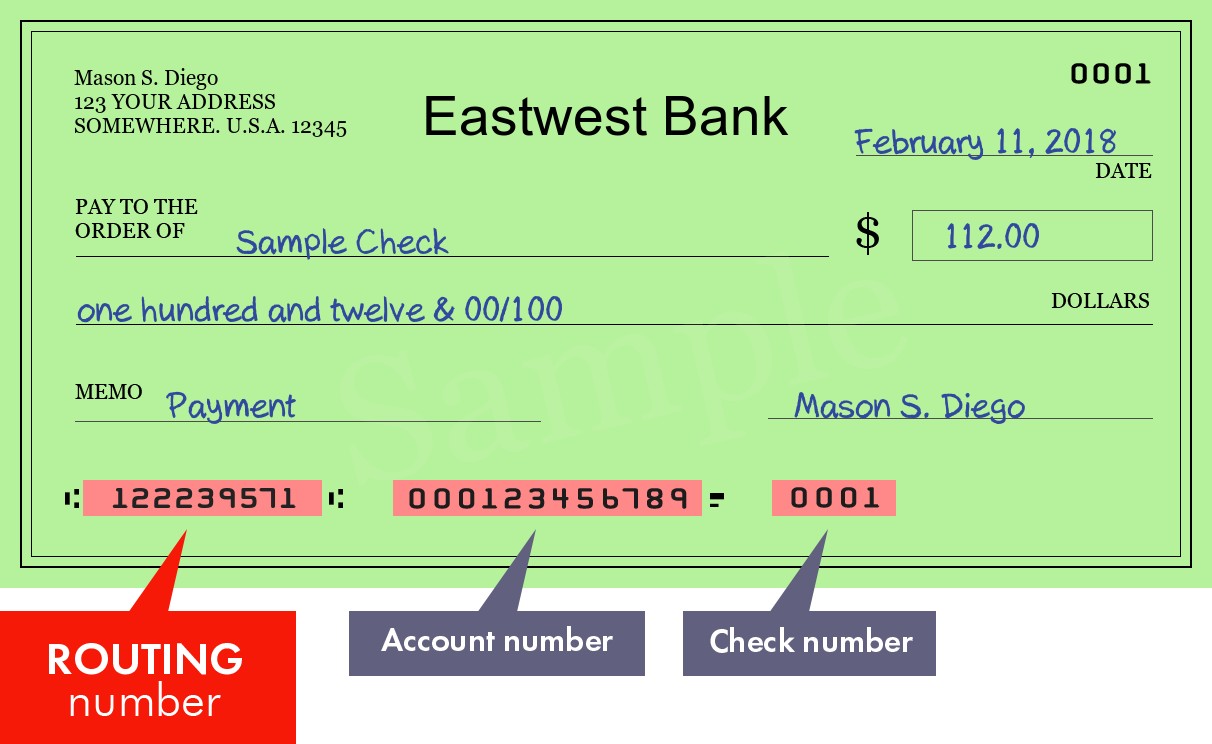

- Signature loans — Speaking of personal loans supplied by banking companies and you may specialist lenders, many of which work on the web. Your credit rating usually mainly see whether you will be approved and the interest rate you’ll spend

- Specialist capital — Either, the brand new builder just who makes your tiny household may offer so you’re able to lend the capital you need. However, score competitive quotes off consumer loan loan providers before you can going. If not, you exposure purchasing excessive mortgage loan

- Cash — Definitely, this is not a selection for most of us. However,, when you’re a resident downsizing so you can a tiny family, expenses cash is a method to prevent all of the funding will set you back

Are built family

Some federal divisions and organizations give mortgage loans to own are created property, for instance the Federal Housing Management (FHA financing), the new Agency for Veterans Factors (Virtual assistant loans), together with Agencies away from Agriculture (USDA money). And be capable of geting a normal home loan having a unique household one to complies which have Fannie mae and you will Freddie Mac’s legislation.

Obviously, you will have to fulfill your lender’s criteria for the credit history, current credit weight, and down payment. And, the are available household you’re to get need satisfy certain tests. It should:

- Get on belongings you own and be anchored so you’re able to a compliant, permanent base

- Bring about 400 square feet of liveable space

- Feel property, meaning you pay assets taxes toward local expert in the place of taxation to the DMV

Little domestic constraints

- Many local bodies impose lowest square footage requirements within their zoning legislation. Ensure that the you to in which you need certainly to create possess moved towards times

- Certain little house be a little more at risk of natural disasters than simply larger property. And insurance vendors might charge you high premiums

- If you would like the lightweight where you can find feel someplace cash advance usa loans in Vail CO secluded, do not forget you will need to spend possibly having utilities connected and for their possibilities. You will want, at least, usage of plentiful, safe drinking water and you may an effective way to cure sewage

- When you see your own lightweight house due to the fact a carry out-it-on your own enterprise, ensure you understand most of the strengthening permits needed. If you have a company, bringing it permits is usually area of the service

Obviously, the largest maximum you face are located in a little area. Americans are widely used to sprawling home that may without difficulty complement both someone in addition to their numerous possessions.

Thus, think twice in the whether you are able to adjust to an excellent relatively confined lifestyle. And you can, if you’ve second thoughts, are leasing a tiny family for your forthcoming travel.

Whether you are to buy or building, the little domestic costs is a lot less than that for an average-measurements of house. Plus the financial savings continue coming as the lightweight belongings are usually less expensive to temperatures or cool and continue maintaining.

It may be difficult to get a home loan into an usually built tiny home. But it’s much easier to get one to order a created domestic, which had been to start with constructed on rims. Of course, you can still finance a non-wheeled little household for many who be eligible for an unsecured loan otherwise contractor loans. And purchasing money is great, when you can.

Comments are closed

Sorry, but you cannot leave a comment for this post.