Contribution Margin Formula, Calculation, Example, Conclusion

Contribution margin is the remaining earnings that have not been taken up by variable costs and that can be used to cover fixed costs. Profit is any money left over after all variable and fixed costs have been settled. Now, add up all the variable costs directly involved in producing the cupcakes (flour, butter, eggs, sugar, milk, etc). Leave out the fixed costs (labor, electricity, machinery, utensils, etc).

When to Use Contribution Margin Analysis

The toy slime has a higher input cost, lowering its contribution margin per unit. This example shows that products with higher sales revenue can give a false sense of profitability, and businesses should be careful of this trap. It’s always a good idea to know your unit contribution margins if you have multiple products. You made $1,000 in total sales revenue after selling 100 units of strawberry bonbons at a $10 selling price per unit.

Managerial Accounting

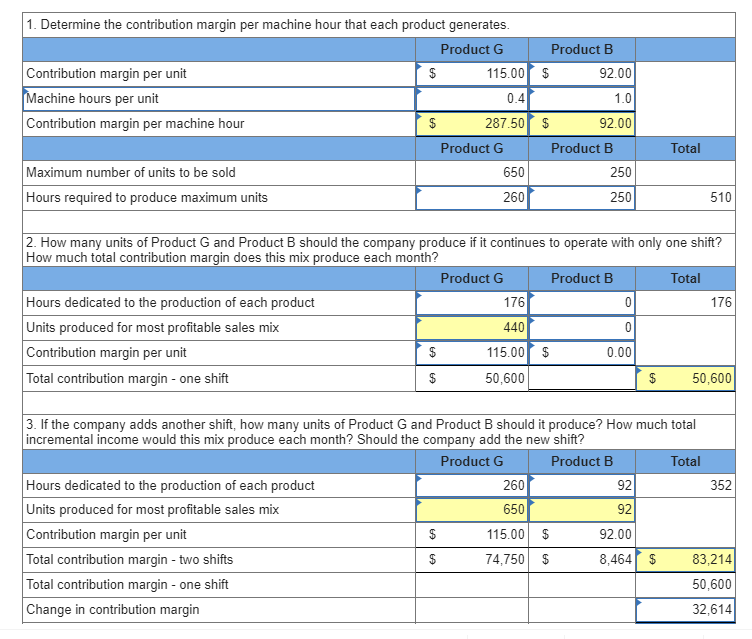

You work it out by dividing your contribution margin by the number of hours worked. That means $130,000 of net sales, and the firm would be able to reach the break-even point. We will find out the break-even point by using the concept of contribution. We will look at how contribution margin equation becomes useful in finding the break-even point. As of Year 0, the first year of our projections, our hypothetical company has the following financials.

How to find the contribution margin per unit using sales revenue?

An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future. The contribution margin is calculated at both the unit level and the overall level. However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio. This is because fee-for-service hospitals have a positive contribution margin for almost all elective cases mostly due to a large percentage of OR costs being fixed. For USA hospitals not on a fixed annual budget, contribution margin per OR hour averages one to two thousand USD per OR hour.

- Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin.

- Instead, management uses this calculation to help improve internal procedures in the production process.

- Since machine and software costs are often depreciated or amortized, these costs tend to be the same or fixed, no matter the level of activity within a given relevant range.

- Variable costs are those costs that change as and when there is a change in the sale.

Company

Now, divide the total contribution margin by the number of units sold. Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency. In the same example, CMR per unit is $100-$40/$100, which is equal to 0.60 or 60%. So, 60% of your revenue is available to cover your fixed costs and contribute to profit. In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights.

Contribution Margin Ratio: Definition

The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior.

Conversely, a negative unit contribution margin indicates a loss at a micro level. Your business cannot continue running in a sound financial state if the cost of production outweighs the margin. The contribution margin may also be expressed as fixed costs plus the amount of profit. To cover the company’s how to find contribution per unit fixed cost, this portion of the revenue is available. After all fixed costs have been covered, this provides an operating profit. A surgical suite can schedule itself efficiently but fail to have a positive contribution margin if many surgeons are slow, use too many instruments or expensive implants, etc.

Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity. Fixed and variable costs are expenses your company accrues from operating the business. For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential. Other financial metrics related to the Contribution Margin Ratio include the gross margin ratio, operating margin ratio, and net profit margin ratio. These ratios provide insight into the overall profitability of a business from different perspectives.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Comments are closed

Sorry, but you cannot leave a comment for this post.