Breaking up Truth From Fictional About USDA Funds from inside the MA

Splitting up Reality Off Fiction Regarding USDA Financing during the MA

When you need to pick a home inside Massachusetts but are not yes if you can loans it, you may want to believe trying to get an effective USDA mortgage.

The USDA loan system is reduced-recognized plus have a tendency to misinterpreted than many other similar mortgage apps, but it has numerous advantages, in addition to a hundred% financing, no advance payment minimizing private financial insurance policies. Believe it or not, USDA financing are not any significantly more limiting than just about any other type from financing, neither are they booked purely to own farmers otherwise services on the center out of nowhere.

Because it’s the job to ensure that you have the suggestions you will want to view all of your mortgage possibilities and select the right one for you, let us take a closer look at the USDA fund when you look at the MA.

Fact: This is certainly perhaps the really pervading myth in the USDA money, so you may be surprised to find quick and fast loans online in Somerset Colorado out that the newest USDA domestic financing program doesn’t fund farms at all. Actually, new USDA has actually a totally particularly for facilities.

Fact: This misconception more than likely is due to the fact USDA money try known as Outlying Creativity financing. As the USDA mortgage program is made inside 1949 to increase the newest cost savings off rural groups, it’s due to the fact stretched to add suburbs — actually men and women into outskirts or big cities — and you may quick locations throughout the MA.

- This new Solitary-Friends Housing Direct Financing, also known as the fresh Section 502 Mortgage System, helps low- and incredibly-low-money people which can be funded and you may serviced privately by the USDA. The fresh USDA lead financing enjoys 33-12 months and 38-year payment selection depending on your earnings height.

- The latest Unmarried-Family members Homes Secured Loan assists lower- and average-income people; it is financed and you will maintained by private lenders however, covered facing standard from the USDA. The fresh new USDA guaranteed mortgage has each other fifteen-season and you can 31-seasons fixed-rates choice.

- Brand new Unmarried-Loved ones Construction Fix Loan & Offer, also known as the new Point 504 Family Repair Program, allows very-low-money homeowners to alter otherwise modernize their houses otherwise clean out fitness and you may defense dangers. Most of the capital for it program exists by the USDA.

Fact: However, there was qualifications requirements having USDA fund into the MA, they have been not any longer tough to satisfy than for any other type away from mortgage. Both foremost requirements are earnings and property eligibility, all of hence start from one state to another and you can condition to county.

The fresh USDA income limitation is dependent on the sum of the earnings of all family avove the age of 18, regardless of whether the name is toward mortgage. The cash have to be lower than 115% of the county’s median income. In terms of assets eligibility is concerned, most major places from inside the MA, particularly Boston, Worcester and you can Springfield commonly qualified. To determine what section are eligible to have an excellent USDA financing in MA, you might refer to brand new USDA’s mapping device.

Fact: It doesn’t matter if you are a first time or 5th day home customer, you can nonetheless qualify for a great USDA financing, provided you only individual you to definitely domestic at the same time and use it as much of your quarters (thus zero resource otherwise trips characteristics greeting).

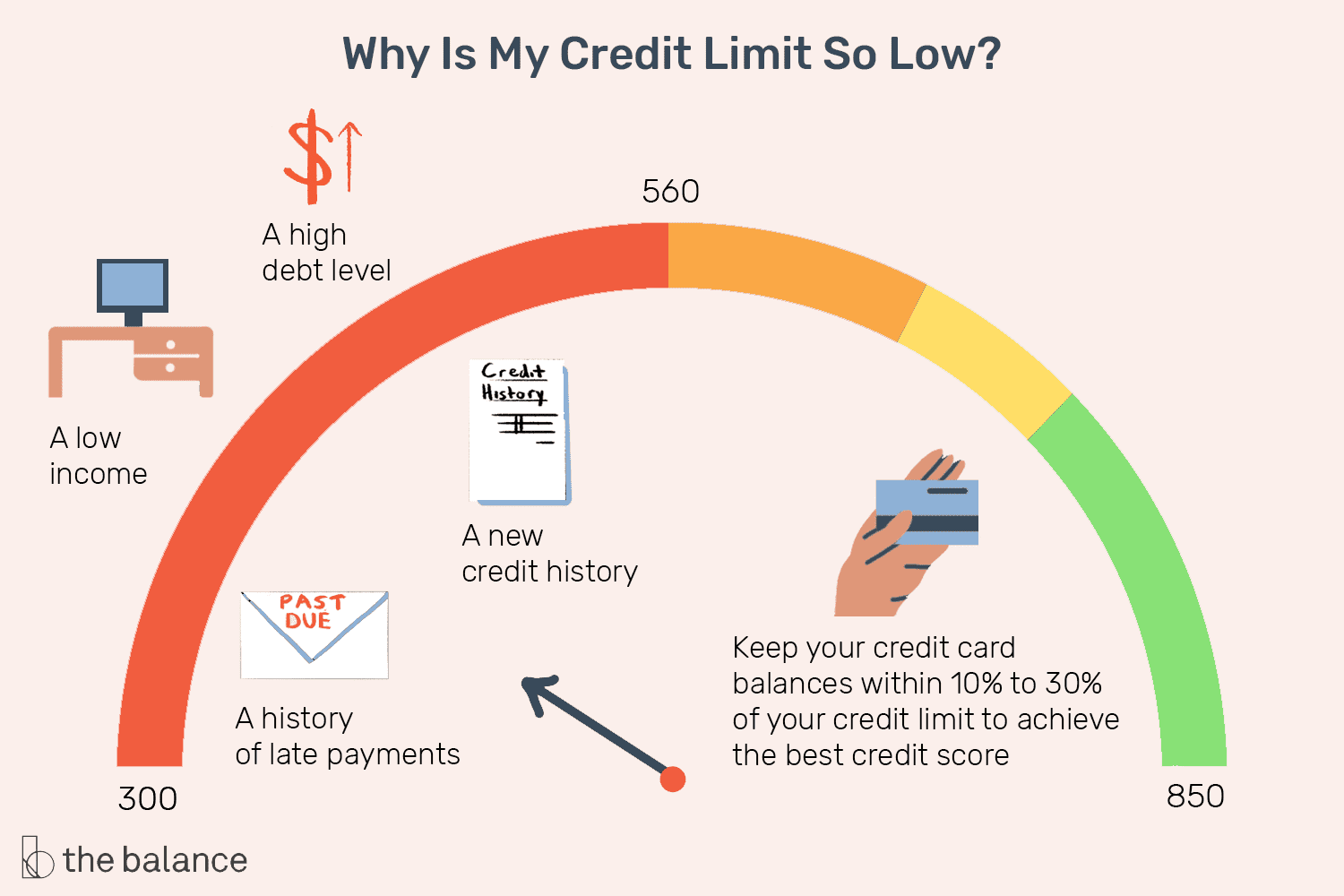

Fact: The fresh new USDA mortgage system is much more lenient to the low otherwise non-old-fashioned credit as compared to conventional loan program. Normally, you would like a minimum credit rating away from 620 so you can qualify for a good USDA mortgage from inside the MA (than the at least 680 to have a conventional mortgage) — however, without having a professional credit rating, you may still qualify. You are able to use other styles out of payment records, like insurance rates payments or utility or cellphone expenses, as a substitute having proven credit rating to help you qualify for an excellent USDA mortgage. These situations try unusual, no matter if you can easily and you will loan providers check consumers which have non-traditional credit rating for the an incident-by-situation basis.

Delight call us that have any additional questions relating to USDA loans during the Massachusetts or to begin with a bid.

As you care able to see, the USDA financial system is present so you’re able to a broader selection out-of borrowers than you possibly might have already felt. So, whether you wish to house look within the Western MA, purchase assets to your South Coast or settle inside the Main MA, a USDA home loan could help reach your objective.

Should you want to discover more about USDA financing inside the MA, as well as if or not you qualify otherwise ideas on how to pertain, communicate with a talented mortgage broker. Brand new dedicated team away from brokers during the Blue-water Financial Firm has actually more than 100 numerous years of combined feel permitting members loans the house of their fantasies. E mail us right now to discover regardless if you are qualified to receive a great USDA financing or even discover what most other home loan products are nowadays.

Roger is an owner and you may signed up Financing Officer in the Blue-water Financial. He finished from the College or university of new Hampshire’s Whittemore University regarding Business and contains already been a commander about home loan community having more than twenty years. Roger possess physically originated over 2500 home-based fund which will be felt to stay the big 1% out-of NH Financing Officials because of the leading national bank Joined Wholesale Home loan.

Comments are closed

Sorry, but you cannot leave a comment for this post.