Benefits and drawbacks out of Tsp Financing: Exactly how Thrift Coupons Package Loans Can impact Your bank account?

Are you a federal staff member otherwise a good uniformed provider user that have a great Thrift Offers Package (TSP)? Provided taking right out a teaspoon financing however, should see the advantages and possible drawbacks? Within this comprehensive book, we are going to delve into the world of Teaspoon financing, examining the components, gurus, limitations, and you can pitfalls. Whether you are contemplating a loan […]

Have you been a federal employee or a good uniformed provider representative with a Thrift Deals Bundle (TSP)? Provided taking out fully a teaspoon mortgage but need to understand the pros and possible disadvantages? Contained in this comprehensive guide, we’re going to explore the realm online installment loans West Virginia of Teaspoon loans, examining the mechanisms, positives, restrictions, and you can problems. Whether you are considering a loan to have an economic disaster, home buy, and other need, we have you wrapped in the very important details to help you make the best choice regarding the senior years discounts.

What exactly are Teaspoon Loans?

Teaspoon money try a component of Thrift Offers Package, designed for government personnel and uniformed service professionals to view finance off their old-age coupons. Just like a great 401(k) loan, Tsp loans try controlled by federal government guidelines, allowing professionals so you can use off their Tsp account efforts.

Mechanism off Tsp Finance:

This new borrowing from the bank procedure pertains to being able to access money from your Tsp account and you may settling the newest borrowed matter having appeal more than a particular period. A fascinating facet of Tsp loans is the fact that the focus repaid goes back into your Tsp membership, efficiently reimbursing yourself.

Advantages regarding Teaspoon Financing:

Teaspoon loans include several benefits that produce all of them an interesting selection for some one trying supply its old-age coupons a variety of aim. Here you will find the key experts:

- Low interest: Tsp money offer competitive interest rates as compared to conventional fund, possibly saving you profit appeal money.

- Zero Credit Inspections: Since the you will be credit from the money, zero borrowing from the bank inspections are essential, streamlining the mortgage application processes.

- Flexibility: Teaspoon funds can be used for diverse requires, anywhere between problems to buying an initial house, bringing financial autonomy.

- Attract Production: The interest you only pay on the financing is actually deposited back into your Tsp account, improving your later years deals.

- Fast Fees: Tsp financing allow for very early repayment versus taking on prepayment punishment, providing economic independency.

Cons out of Teaspoon Money:

- Compulsory Costs: Individuals is actually exposed to required fees for the Teaspoon money, that may put an additional expense towards amount borrowed.

- Stunted Gains: Because of the withdrawing funds from their Teaspoon benefits, the opportunity of funding development in your retirement fund was dampened.

- Borrowing from the bank Hats: Teaspoon finance provides borrowing from the bank limitations, limiting extent you have access to centered on a portion out of your bank account harmony.

- Taxation Difficulties: Failure to stick to financing payment advice can cause income tax ramifications and you can potential charges, affecting your financial obligations.

Getting a tsp Loan?

Acquiring a tsp loan concerns a structured means, encompassing various steps to make sure a smooth and really-informed credit feel. Why don’t we walk through this type of crucial procedures to guide you from Teaspoon loan application process.

Evaluate Loan Eligibility and you will Financing Form of:

Step one into the getting a teaspoon mortgage entails researching their qualification centered on the government employment reputation and you will examining in the event your Tsp balance suits this new discussed tolerance to own loan degree. Simultaneously, deciding the borrowed funds kind of you to aligns along with your requires is key. General-objective finance offer shorter fees terms and conditions, if you find yourself residential funds, aimed at home sales, promote offered fees periods.

Influence Loan amount:

Cautiously figuring the borrowed funds count you wish to acquire is essential. Evaluating debt standards and you may installment capabilities is very important to quit limiting retirement discounts if you are facilitating quick financing fees.

Over Requisite Files:

Comprehensive end out-of loan records try pivotal, particularly for domestic money which need proof of number 1 quarters get or construction. Making sure precise and you will over files submitting is essential to help you expedite new approval process.

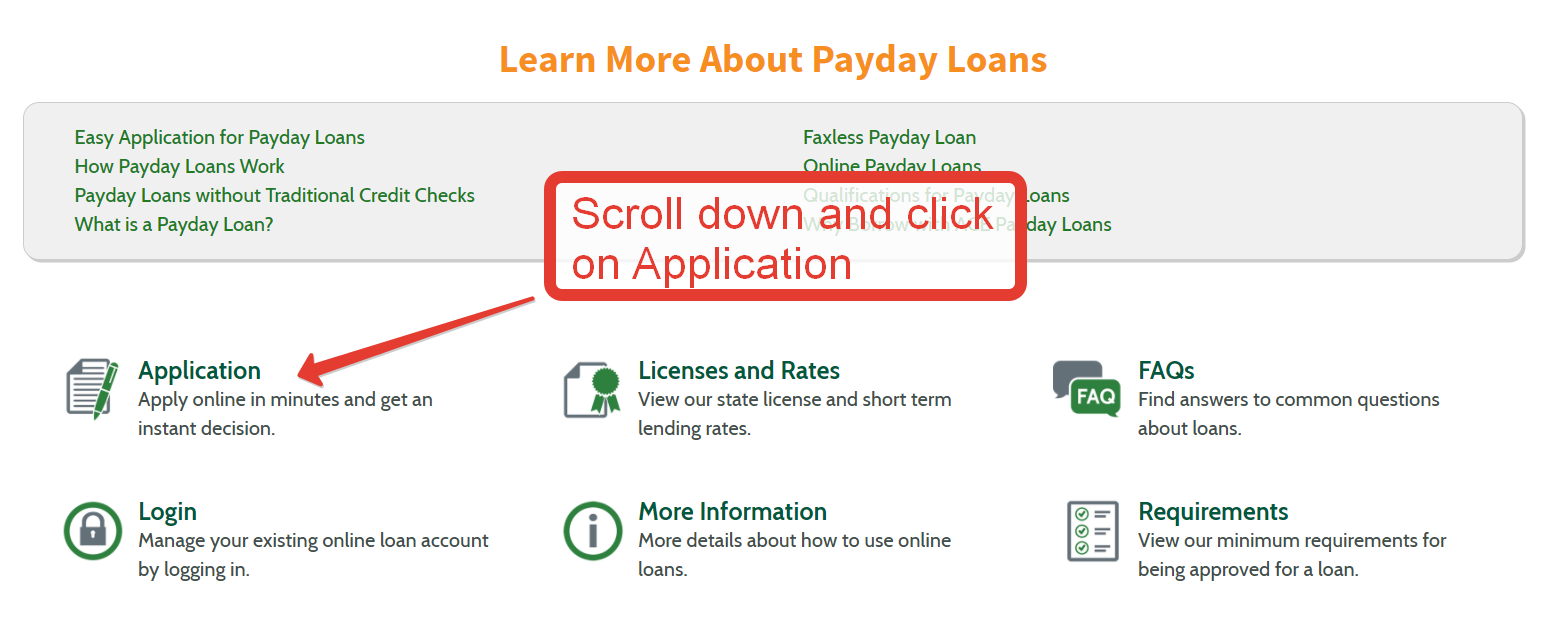

Fill in Financing Consult:

Officially submission your loan demand can be accomplished from the Teaspoon web site or by mailing a papers loan application designed for down load toward Teaspoon website. Early in the day verification off records and you may attachments encourages a flaccid recognition techniques.

Pay-off Mortgage because Arranged:

Timely payments are vital to guarantee the steady replenishment of your own advancing years funds, generally by way of head income write-offs. Adhering to the fresh new installment schedule mitigates possible charges and you can tax debts, defending your financial balances.

Teaspoon Financing Qualifications and needs:

Understanding the qualification requirements for Tsp loans is very important to own a beneficial effective loan application. Trick factors tend to be government a job reputation, minimum account balance criteria, and you will specific loan designs that have differing installment periodsprehending these types of requirements try crucial to browse the loan application techniques effectively.

When to Consider a tsp Mortgage:

Determining in the event that if in case to follow a tsp mortgage is a great extreme decision you to definitely deserves consideration. When you find yourself this type of financing render a channel to access old age offers, it is important to consider the situations not as much as which a tsp loan would-be a viable alternative. During issues, high-focus loans administration, household instructions, otherwise educational activities, a tsp loan could possibly offer financial recovery. However, its imperative to measure the influence on long-title financial expectations and you can old age coupons ahead of choosing so it economic method.

Conclusion:

Since the we’ve traversed the latest land away from Tsp finance, we uncovered the fresh new nuances of their systems, professionals, pressures, and you will critical factors. Navigating the latest ins and outs off Tsp funds requires a properly-informed strategy, straightening your financial behavior having long-term senior years specifications. Whether you are contemplating financing for instantaneous monetary demands or much time-label motives, guaranteeing a healthy approach is actually crucial for your monetary better-getting.

Having an extensive knowledge of Teaspoon loans, you’re well-supplied to check on the latest feasibility regarding a teaspoon loan and then make told behavior aimed together with your financial aspirations.

what’s qrius

Qrius decreases difficulty. We give an explanation for vital affairs of our big date, reacting issue: «Precisely what does this suggest personally?»

Comments are closed

Sorry, but you cannot leave a comment for this post.