A comprehensive Guide to own Very first-Go out Homebuyers when you look at the Oakland State, Michigan

Michigan Real estate agent Liberty Ways Realty | Profit, Transformation Leaders

Oakland State, Michigan, has experienced a flourishing real estate market over the past ten years, therefore it is a fantastic destination for very first-go out homebuyers to take on. Since you carry on so it exciting journey, it is important to case oneself to the studies and you may insights requisite and also make informed conclusion. So it complete book offers trick analytics, styles, and you can suggestions to help you navigate Oakland County’s active a residential property landscape, also investment recommendations options available to help you earliest-go out customers.

Oakland County’s A home Progress

One of the most hitting evidence of area’s gains was the main boost in median home sales costs. Out-of , the new median marketing price soared off $100,000 in order to $290,000. Which steady up development displays the brand new expanding desirability of part and underscores the stability of your local housing marketplace. For very first-date homeowners, these statistics signal an audio enough time-label funding for the a thriving neighborhood.

Seasonal Activity and Time You buy

Whenever examining the info, it is crucial to envision seasonal action in the business. In the Oakland Condition, the fresh new spring season and you will summer time commonly get a hold of large average marketing rates. Such as, the newest average family purchases price into the , while in order to $350,000 into the 2023. To maximize your allowance and you will contain the best deal, it could be good-for talk about the market when you look at the slide and you may winter months whenever battle and you can prices tend to be down.

Handling a local Real estate agent

Just like the a primary-day homebuyer, it is essential to work on an informed regional agent who will give understanding towards local field and you can guide you from property procedure. They’re able to help you choose areas that suit your position and you will needs while maintaining a record of the fresh new style and you will solutions. On top of that, be ready to operate rapidly when you look for a home your love, while the good demand for home when you look at the Oakland Condition often leads so you can severe competition and fast-paced purchases.

Pre-Approval and you may Money Solutions

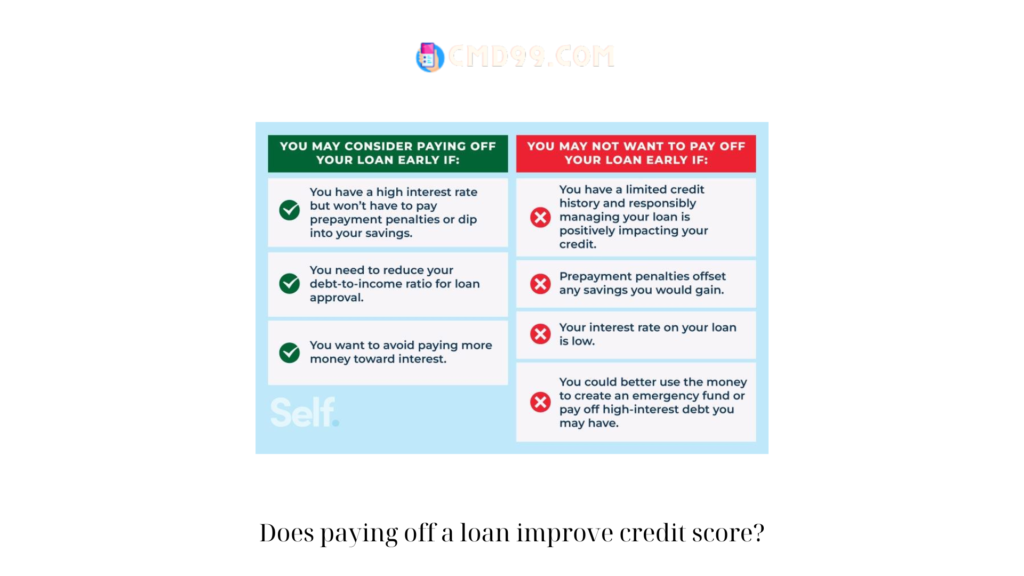

To further improve your odds of achievements, consider taking pre-acknowledged to own a mortgage before you start your home look. Pre-acceptance gives you a much better comprehension of your allowance, demonstrate to vendors that you’re a critical consumer, and you will possibly expedite the brand new closing techniques once you’ve receive your dream home. As the a primary-date homebuyer, you will be eligible for individuals incentives and deposit recommendations programs that will generate homeownership a whole lot more obtainable.

Of a lot earliest-time homebuyer programs come from the federal, county, and you can local accounts. The Federal Construction Administration (FHA) has the benefit of funds having reduce fee requirements (only step three.5%) and easy credit rating criteria, so it’s an appealing selection for basic-big date people. The brand new U.S. Agencies regarding Pros Activities (VA) and the You.S. Agency out-of Agriculture (USDA) bring loan apps designed to help certain categories of homeowners, such as for example veterans and people trying belongings in the rural components.

At the county height, the fresh new Michigan State Homes Invention Authority (MSHDA) provides various apps to greatly help first-time homeowners. The brand new MSHDA even offers downpayment guidelines around $7,five hundred to have qualified individuals, which can be a serious increase when saving having an all the way down payment. As well, brand new authority will bring home loan borrowing from the bank licenses, that allow homeowners so you can claim a national income tax credit to have an effective part of its home loan interest paid a year.

In your community, specific Oakland State municipalities may offer her very first-time homebuyer guidance software. These types of applications can include downpayment recommendations, low-desire finance, or grants. It’s essential to look and you can connect with regional housing providers, non-earnings teams, otherwise their real estate agent to learn about the particular opportunities available in your own address neighborhoods.

Financial Certain Bonuses and Apps

Fundamentally, remember to require people special bonuses otherwise recommendations offered because of your financial. Specific banks and you may borrowing unions promote earliest-date homebuyer applications that are included with straight down interest levels, shorter settlement costs, if you don’t down-payment matching fund. By firmly taking advantageous asset of these types of programs, it is possible to make your house buying procedure cheaper and you may possible.

Summary: Keys to Success in Oakland County’s Housing market

In a nutshell, navigating Oakland County’s real estate market since the a first-day homebuyer need a thorough understanding of key trend and you will analytics, coping with a city realtor, and you may preparing yourself into real estate techniques. From the protecting pre-recognition to own home financing and exploring first-time homebuyer bonuses and you may down-payment guidance software, you can rather alter your chances of victory contained in this aggressive field.

Determination, Perseverance, and you will Homeownership inside the Oakland County

Since you embark on the new fascinating travel out of homeownership when you look at the Oakland Condition, remember that persistence and you may perseverance are necessary. While the home buying procedure shall be difficult, the fresh new rewards regarding owning your first home in a thriving neighborhood eg Oakland County are very well worth the work. Maintain your eyes for the award, control the fresh new info and direction apps available to choose from, and soon enough, you are settling in the fantasy household within thriving Michigan area.

Comments are closed

Sorry, but you cannot leave a comment for this post.