6 Vital Problems To quit Following Your own Financial Pre-acceptance

six Important Errors To get rid of Pursuing the The Mortgage Pre-recognition

Congratulations! You’ve received a good pre-acceptance out of your home loan company, and are away looking at home! This is certainly no time so you can disorder anything upwards. Educated mortgage officers will always be admonish borrowers to store some thing the latest identical to he or she is as of committed of one’s pre-approval, but every once in awhile a debtor tend to ignore the financing officer’s information while making one or more of those crucial mistakes while they circulate on the brand new closing. Just remember that , a mortgage pre-acceptance has no worth-and does not join the financial institution-if the economic image alter amongst the issuance of the preapproval letter therefore the official application is canned. So here are the six most significant errors to eliminate when you have been pre-recognized to own a mortgage:

- Late money. Be sure that you are still most recent towards one monthly obligations. When you have costs repaid immediately paid out of one’s checking membership or from the bank card, you should, continue doing urgent link therefore. Their pre-recognition simply describes a snapshot of one’s finances, and you ought to keep this an identical otherwise most readily useful since the if the pre-approval picture is removed.

- Obtaining brand new lines of credit. Lenders are required to do a later on credit assessment in advance of the mortgage shuts. They generally carry out what is actually entitled a beneficial smooth remove of one’s borrowing, and that says to all of them if any the brand new personal lines of credit was open. People the new credit membership you may adversely impression your credit rating. This might lead to a top interest rate if not results inside postponing their closure. People seeking present their new land can probably be looking to buy the latest furniture and to date the item of furniture birth in order to coincide due to their closing. The stores give works closely with zero repayments due getting weeks or also years to your the fresh new chairs. When you are relatively a capital promote, checking the newest credit line you will definitely threaten your mortgage financing.

- And also make large requests. To invest in high priced chairs or equipment having credit you are going to replace your loans-to-earnings proportion, which will bring about a put off closure or denial of your financing in the event your ratios were tight to start with. Even although you use your own cash and then make big commands, you will end up the deficiency of cash on hand to have set-aside requirements, that will and negatively impact your loan. Best thing accomplish try continue something since they are shortly after you are acknowledged.

- Repaying and you can closing credit cards. Credit scores was affected by numerous something. One of them try repaying and you may closure credit cards. Although it looks counterintuitive, paying down and you may closing credit cards have a tendency to adversely impacts fico scores. Also, depleting fund on the bank account to settle credit cards does mean down cash supplies.

- Co-signing fund for other individuals. Specially when it is a unique loan, co-signing financing for the next implies that the borrowed funds try an effective debt toward borrower and also for the co-signer. It does enter the financial obligation-to-earnings proportion blend. So think twice in advance of providing she or he otherwise sis purchase an excellent auto, at the least until once you buy closes.

- Changing efforts. Even though it’s a higher-paying work, modifying work immediately after finding an excellent pre-approval can cause a delayed in closing because of confirmation requirements. Your brand new income should be confirmed, therefore a couple of paystubs was asked, as well as the the newest job verified through to the financing was cleaned to shut.

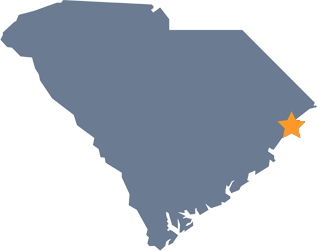

Contact All of our Massachusettes Home Attorneys

Bottom line it is important you stay in touch with your mortgage administrator ahead of starting any high financial moves, as actually seemingly of good use alter possess a poor impression during the the changing times and days before your closure. To find out more about a home things, e mail us.

Comments are closed

Sorry, but you cannot leave a comment for this post.