Handling setbacks and you will changes in company show

The truth is, there is absolutely no strict demands into the The fresh new Zealand that when you might be self-operating or a specialist you really need to have experienced organization to possess at least 24 months before a financial usually envision providing home financing.

Just like the Aseem Agarwal, Lead of Mortgage loans in the Globally Finance said, documents served by accounting firms and you can copied with annual tax statements and you will GST output to enable financial institutions to assess mortgage qualifications no matter if your organization has been doing procedure for less than just 2 yrs.

Loan providers has self-reliance

Whenever granting a mortgage, banking institutions just take a lot of circumstances into account, and they’ve got freedom whenever determining the newest qualification loans in Boaz men and women which have unpredictable earnings. They may be able fool around with strategies instance profit and loss statements, financials, and cash disperse predicts to evaluate financial stability.

So, if you are self-employed otherwise a builder, it is important to work with to provide a powerful instance backed by economic files that give a thorough breakdown of earnings as opposed to becoming postponed by misconception one to a-two-12 months providers history are a strict significance of bringing home financing acknowledged. For every situation is known as really, along with the right suggestions, papers and you can economic believed, you could effectively rating a mortgage.

Let us glance at some situations Aseem Agarwal provided exactly how financial institutions evaluate mortgage qualifications if you are self-operating, builders, otherwise new clients citizens.

The issue of abnormal money

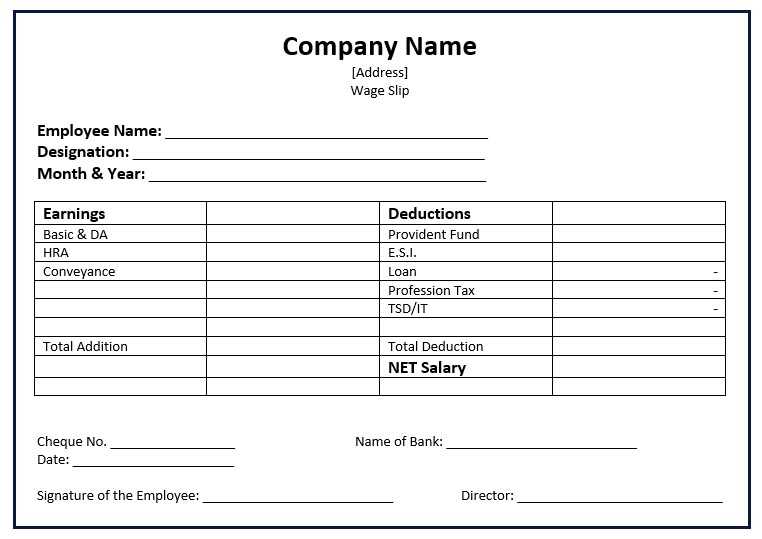

Aseem Agarwal teaches you: Giving banks count on from inside the situations where money will likely be unpredictable, we recommend clients to provide an income and you can losses statement waiting because of the an accountant. Combined with annual income tax and GST yields, it’s got an obvious image of your otherwise business’ earnings more than a particular period.

Comprehending that your revenue may will change falls under why banking institutions and you may lenders are incredibly crucial that have care about-working and you can contractor loan requests. They understand that money can vary with respect to the times or day you could list a decreased few days when you are waiting around for an charge, alternatively if you’ve just accomplished a huge jobs, you will have increased money for this several months. This is why mortgage lenders like to see earnings style more time to ensure that you’re able to pay-off the loan. If you have had people major expenses otherwise there are particular dramatic alterations in the sales numbers, you need to be capable describe why.

From the presenting income and losings declaration, backed by your accountant wishing financials, the financial institution might have a lot more believe in the determining your own annual money, unlike relying on day-to-times differences.

When you find yourself an alternative organization

Aseem continues to say, Getting people with below 12 months away from procedure, banks may deal with a cash flow forecast served by an enthusiastic accountant. As bank can get disregard otherwise downplay the new estimated earnings a little to get to know financing conditions, it permits to own money you to definitely have not but really come realised becoming taken into account, offered, definitely, they aligns that have practical presumptions.

To simply help decision-suppliers determine how stable your business is as well as most likely future, they will wish to know a lot more about that which you perform on the providers, and just how much feel you have in your fieldbining one to guidance that have an income anticipate prepared by a keen accountant to display probably earnings and you may future expenditures will assist get you closer to providing a home loan.

Additionally, it is crucial that you’re capable explain and you will justify the financial history. Remarkable dips and you may increases inside the sales quantity, or high costs, is go off alarm bells. But if you provides an effective reasoned reason, it will make a significant difference. You’ll need to be able to let you know exactly what has evolved; exactly what contributed to prior bad age otherwise just what possess resulted in brand new turnaround in the market in the present financial year.

Regardless of if a corporate encountered challenges previously, finance companies normally consider the current monetary year’s abilities. An earnings anticipate outlining asked earnings toward left seasons will be pivotal.

Think about the effect from outside things including the COVID-19 pandemic. Aseem provided the fresh new exemplory case of a hair salon. Like many businesses, these were not trading because they was inside the lockdown.

They certainly were never a detrimental organization, although nature out-of team didn’t permit them to open. Now they have gone back to typical levels. Just after one or two bad decades, they have been now exchange at full ability. For this reason, the bank try ready to glance at the current year’s overall performance and feet their choice thereon earnings height.

Giving an income prediction discussing brand new turnaround and emphasising confident change, the lending company can look on current year’s abilities when making mortgage choices.

Professional help can make the essential difference between getting a mortgage or maybe not

If you find yourself self-functioning, a contractor otherwise features another type of team and so are trying to get home financing, you need to get in the advantages, such as for example a keen accountant and you will a large financial company.

For the best financial paperwork, instance profit-and-loss statements and money move forecasts, and you may service away from Global Finance’s home loans, you could successfully present an effective situation to own loan qualifications, despite that person regarding setbacks otherwise alterations in company overall performance.

Dispelling both-seasons misconception

Aseem Agarwal, head out of financial party from the Global fund says that have elite presentation of your own application for the loan, All of our home loans is right here that will help you , getting designed selection to have mind-functioning anybody and new customers customers. Into right approach and you can documentation, protecting home financing isnt simply for exactly how many age running a business.

The team from expert financial advisors at the Internationally Fund is also explain exactly what is requisite and help to make sure you give a proper-presented image into the lender otherwise financial.

Their accountant normally ready your financials in a fashion that certainly reveals your financial status. They are able to prepare yourself earnings forecasts to exhibit more than likely income and you will expenditures and so the financial can have the brand new trust so you can base the choice on that quantity of exchange.

To one another, we could make it easier to secure home financing. So, get in touch with a global Fund representative now for expert advice and you will service together with your home loan software to the 09 2555500 otherwise send an email in order to

All the info and you will blogs blogged are true towards best of the worldwide Financing Properties Ltd studies. While the pointers given within blogs is out of standard nature which can be maybe not meant to be customized financial guidance. We remind you to seek Monetary guidance that’s customized founded on your needs, requirements, and you will situations prior to making people monetary decision. No person otherwise people whom depend myself otherwise indirectly abreast of information within this article get keep Around the world Monetary Properties Ltd otherwise their group responsible.

Comments are closed

Sorry, but you cannot leave a comment for this post.