See Aggressive BMO Home Equity Line of credit Prices Glance at Today!

BMO Domestic Equity Line of credit Rates

While a homeowner considering tapping into the value of the household, you might have look for the word Domestic Security Personal line of credit (HELOC).

Facts Home Guarantee

If your home is really worth $three hundred,000 and you nevertheless owe $200,000, your house security are $100,000. This security is going to be tapped toward by way of some means, and a great HELOC is one of the most versatile options available.

With a definite comprehension of your home collateral is empowering. They enables you to funnel the value you collected in your property.

Regardless if you are think a primary recovery, trying combine high-notice financial obligation, otherwise preparing for surprise costs, recognizing simply how much security you really have ‘s the initial step.

The beauty of property Equity Personal line of credit

Why do you believe a good HELOC over other forms off credit? A HELOC is actually a revolving credit line, similar to a credit card.

In the place of choosing a lump sum, you have made a credit limit according to your residence guarantee, letting you draw finance as needed.

Which freedom will be incredibly beneficial in dealing with your finances. You have to pay appeal into matter your withdraw, for example if you like a smaller amount, you may not be burdened which have desire to your continuously financing.

This may help save you a lot of currency while credit to possess large-attention expenditures. BMO’s costs was competitive, therefore it is an option really worth examining.

BMO’s Approach to HELOC Cost

In relation to BMO for your home guarantee line of credit, you might be interested in exactly how Modesto installment loans bad credit their rates accumulate.

BMO typically even offers changeable pricing that will be tied to a list, in addition to an excellent margin, according to your creditworthiness and also the details of your situation.

It is vital to understand that this type of prices is change considering markets criteria, thus keeping track of normal position of BMO will be of good use.

Facts Affecting Their Speed

You are probably questioning, Just what determines my specific speed? High question! Several facts need to be considered when BMO analyzes and this speed is applicable on HELOC. Here are some critical indicators:

- Credit history: Your credit report try a crucial factor. New healthier your credit rating, the greater your chances of protecting a great rates. Lenders eg BMO want to be sure to has actually a history out-of paying off expenses sensibly.

- Loan-to-Really worth Ratio (LTV): So it ratio compares the degree of your home loan with the appraised value of your home. A lowered LTV ratio generally mode a much better rates. In the event the more of your home is reduced, you will probably be eligible for less interest.

- Assets Kind of: The kind of possessions may affect the speed. Should it be a single-family home, an apartment, otherwise a multiple-product house makes a change in how BMO analyzes chance.

Economy Styles

Interest levels normally swing considering some field conditions, for instance the main bank’s policy decisions, rising cost of living pricing, together with full need for borrowing from the bank.

Remaining an ear to the surface out-of these types of styles will help you go out the application to find the best possible rate off BMO.

Ideas on how to Make an application for good BMO HELOC

Start with collecting called for records, for example proof income, details on your existing home loan, and you can facts about your house’s well worth.

Think of this due to the fact a chance to keeps an open dialogue which have good BMO member, who can guide you as a consequence of the certain offerings considering the means.

Controlling Their HELOC Responsibly

After you safe their HELOC, the burden changes for you. While the appeal away from easy access to fund will likely be enticing — especially for large projects or expenditures — it’s important to help you means the personal line of credit judiciously.

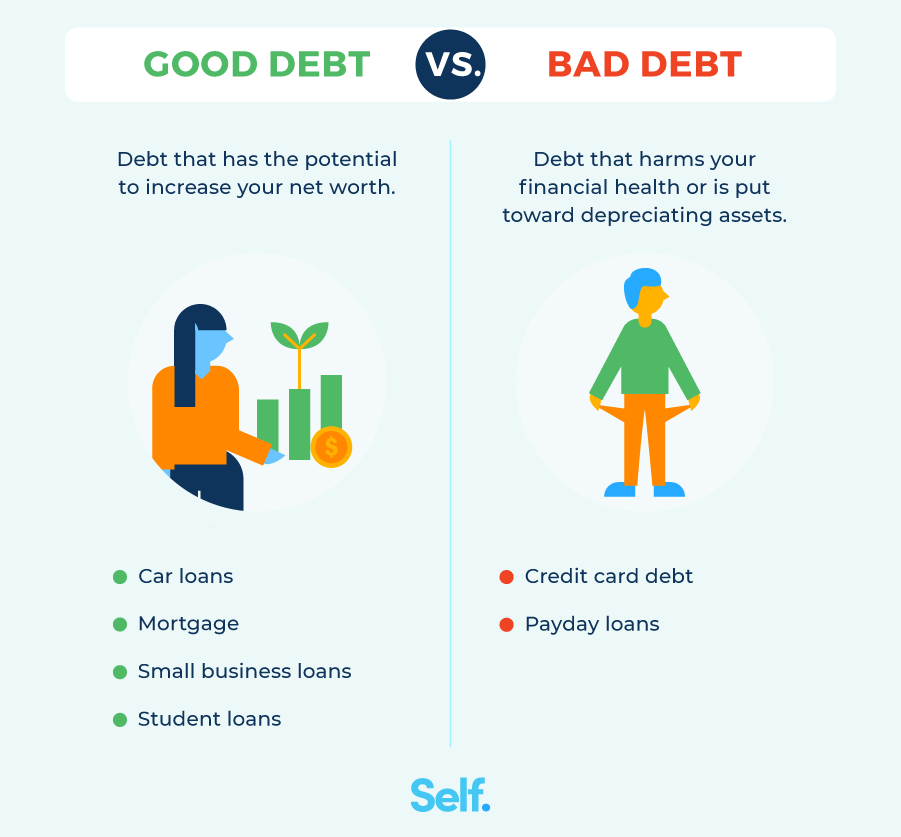

Allow it to be a practice to help you plan your withdrawals cautiously. Use your HELOC getting objectives one to undoubtedly require it, particularly renovations which could improve your value of or merging large-attract expenses.

Payment Design

Today, let’s talk about just how cost works together with an excellent BMO HELOC. Really HELOCs have a couple of phases: the new mark period and the fees months.

Yet not, when the payment months kicks within the — which can history from 10 to help you twenty years — you’ll want to initiate repaying the main alongside attention.

It’s crucial to bundle ahead for this phase. Setting aside financing on a regular basis when you look at the mark several months, thus you’re not caught out-of-protect when repayments initiate, tends to make a change.

Positives and negatives from BMO’s HELOC

Like most monetary product, a beneficial HELOC of BMO boasts its own group of experts and you can downsides. Knowledge these can empower that create a knowledgeable choice.

- Flexible The means to access Money: You could obtain what you want as it’s needed, providing you monetary breathing space.

- Down Rates: Basically more affordable than simply signature loans otherwise handmade cards, especially for big figures.

- Prospective Tax Write-offs: In many cases, the interest paid back are tax-deductible when the employed for renovations.

- Changeable Rates: This new changing characteristics of the pricing can lead to unforeseen grows during the monthly obligations.

- Danger of Foreclosure: Just like any secured financial obligation, if you can’t repay, you’ll be able to exposure losing your residence.

- Financial obligation Period Risk: The convenience of borrowing can result in overspending, and work out in control monetary decisions essential.

The necessity of a resources

This can promote understanding of just how in balance your financial responsibilities are and can make it easier to make smarter behavior concerning your distributions.

What’s more, it gives you deeper manage and you can visibility into your monetary disease, which makes it easier to anticipate pressures prior to it happen.

Combining an excellent HELOC with other Monetary Steps

In that way, should you need tap into your HELOC to have unexpected costs, you may not need completely rely on it.

Using a HELOC together with a great diversified monetary plan can also be present a shield resistant to the unpredictability out of lifetime.

You can become more secure on the decisions when you understand your has actually supplies beyond simply your residence equity in order to lean for the.

Looking to Elite Monetary Advice

Its professional information is light up options and you may dangers you may not features noticed, working for you browse the new have a tendency to-complex field of house security fund and you will personal lines of credit.

Conclusions to the BMO’s HELOC Cost

To conclude, BMO’s domestic security credit line rates would be an appealing choice for of many property owners trying to leverage their property’s well worth.

Information your property collateral and how HELOCs squeeze into a comprehensive monetary approach allows you to take-charge of one’s future.

Thus proceed, mention the choices which have BMO, and find out the best way to use your family security to attain your goals!

For folks who receive this information helpful, I would fascination with you to clap because of it, get off a review with your thoughts otherwise issues, and think becoming a member of my Typical newsletter to possess coming status and you will expertise. Thanks for reading.

Comments are closed

Sorry, but you cannot leave a comment for this post.