3. Name Browse and Insurance policies: Securing Your own Appeal

Refinancing a keen financial may also feature tall settlement costs, together with appraisal charges, origination charge, and label insurance coverage. Such can cost you adds up easily that will discourage consumers out of seeking refinancing.

Mitigation

Individuals is decrease the possibility of high settlement costs because of the negotiating that have lenders or exploring choices for lower if any-closing-rates refinancing. It is very important very carefully review new terms and conditions regarding the fresh new refinancing offer and you may check out the long-name costs effects before deciding.

Refinancing an mortgage presents a unique number of pressures and you can potential risks to possess individuals. By understanding and you will mitigating these dangers, individuals can be browse the latest refinancing procedure more effectively and then make advised decisions. Selecting the advice out of a home loan elite and you can meticulously evaluating the brand new various available options may help individuals get to their financial specifications if you are minimizing prospective cons.

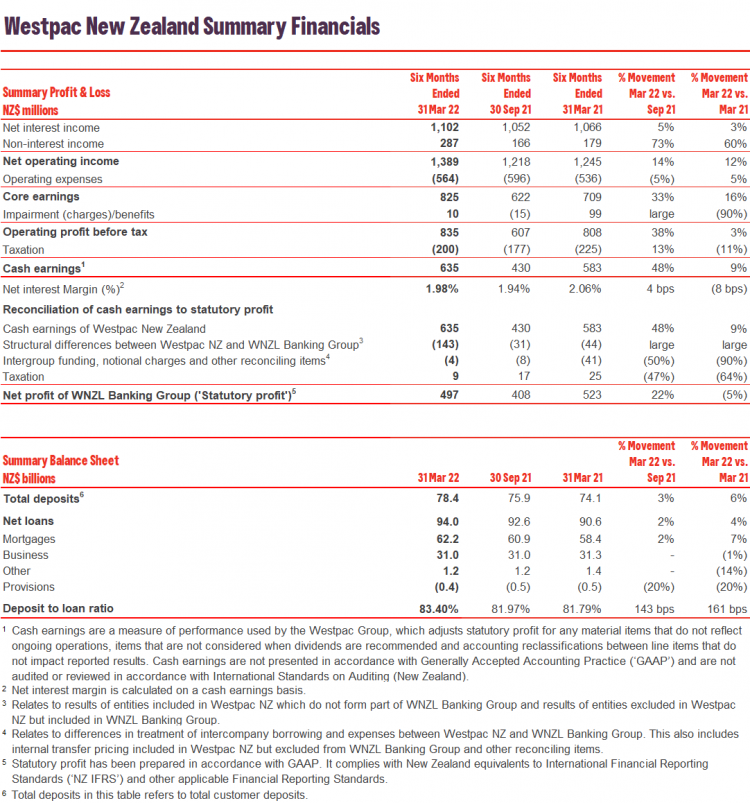

Prices for Mortgage refinancing

Refinancing your own mortgage can be a terrific way to save money on the rates, lower your monthly premiums, otherwise pay back the loan shorter. You will need to just remember that , the newest refinancing procedure is sold with its group of will set you back and you may charges. These charge can vary with respect to the lender as well as the facts of your own financial, however it is crucial to grounds them in the decision to refinance. Let us take a closer look in the some of the related will cost you and you may charge mixed up in refinancing processes.

Same as applying for home financing, refinancing generally involves a loan application percentage. It payment discusses the administrative will cost you of operating the application and can range off a couple of hundred dollars so you’re able to up to a great thousand cash. It’s important to observe that this payment are low-refundable, therefore you will have to consider it when determining whether to just do it towards refinancing processes.

To select the most recent worth of your residence, lenders tend to need an assessment. An appraiser commonly see your home and you will evaluate their worth situated towards points instance place, dimensions, condition, and you can present revenue rates regarding similar belongings in the region. The brand new assessment payment may differ but is usually regarding diversity of some hundred or so cash. While this commission is necessary, it can be a worthwhile financing in the event it makes it possible to safer a far greater interest rate otherwise loan words.

Within the refinancing techniques, a concept research is completed to ensure that there are no liens or any other issues with the brand new property’s control. So it research is generally performed by the a name team, in addition to rates is frequently passed away into debtor. Lenders may require that get term insurance policies to guard facing any unforeseen possession situations. When you find yourself these fees could add a critical pricing with the refinancing procedure, he’s very important to securing their appeal and making sure a silky transition.

This new origination payment try a fee charged by the bank for control your loan software and you will performing the new mortgage. It is usually calculated because a share of the loan amount and will consist of 0.5% to a single% of one’s full loan. Although this commission is nice, it is very important consider the possible coupons of refinancing so you’re able to determine if they outweighs the price.

5. Settlement costs: The past Boundary

Exactly like when you bought your home, refinancing together with involves closing costs. These types of can cost you tend to be items such as for instance lawyer charges, credit file costs, escrow costs , and you can tape fees. Whenever you are settlement costs can differ with respect to the lender and also the specifics of the home loan, they typically may include 2% so you can 5% of one’s amount borrowed. It is vital to foundation these types of costs in the choice so you can refinance, as they can significantly change the overall coupons you might achieve.

Comments are closed

Sorry, but you cannot leave a comment for this post.