2 2 Future Value of Annuities Mathematics of Finance

For education savings, they assist in projecting the growth of savings over time to meet the cost of future education expenses. Secondly, calculating the future value of an annuity assists in making informed decisions about financial products and investment strategies. By understanding how much a series of payments will be worth in the future, one can compare different investment options, assess risks, and align financial decisions with long-term objectives. Simply put, Future Value refers to the worth of a current asset or a series of cash flows at a specified date in the future, assuming a certain rate of interest or growth. In the context of annuities, it specifically pertains to the accumulated value of regular payments (annuities) made over time, including the interest earned on these payments.

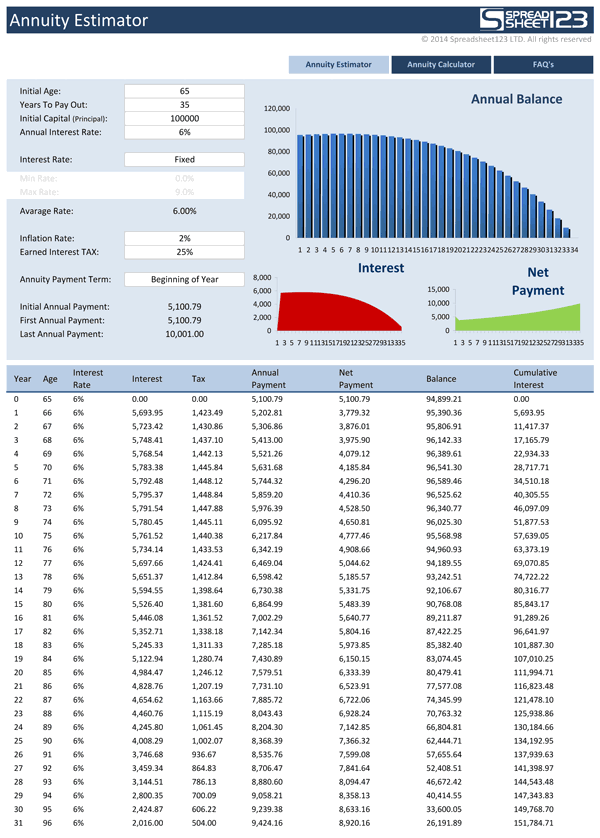

How To Use the Variable Annuity Calculator

Future value, on the other hand, is a measure of how much a series of regular payments will be worth at some point in the future, given a set interest rate. If you’re making regular payments on a mortgage, for example, calculating the future value can help you determine the total cost of the loan. The CAGR calculator measures the mean annual growth rate of an investment over a specified time period longer than one year. It represents one of the most accurate ways to calculate and determine returns for anything that can rise or fall in value over time. The impact of changing interest rates and economic conditions is a vital consideration in these calculations.

Why $1M Is No Longer Enough for Retirement

In essence, the future value of the annuity is a powerful tool that provides a clear and quantifiable understanding of the long-term implications of financial choices made today. Whether for personal savings, investment planning, or retirement preparations, mastering this concept is key to building a secure and predictable financial future. The calculator also requires information about your fixed annuity, like the starting balance, initial interest rate, expected average interest rate and minimum guaranteed rate. To use this fixed annuity calculator, simply fill out the fields with information about yourself and your fixed annuity. You’ll input details including your current age and tax rate as well as the age and tax rate you’ll be at when you intend to start withdrawing from your annuity.

- Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news.

- Whether for personal savings, investment planning, or retirement preparations, mastering this concept is key to building a secure and predictable financial future.

- When you click the “calculate” button to submit your information, the calculator will show you the expected value of your fixed annuity at the time of withdrawal.

- If no data record is selected, or you have no entries stored for this calculator, the line will display «None».

- Determining the future value of an annuity is critical when deciding whether to invest.

- But even this simple example, which did not require an interest conversion, is cumbersome, and time-consuming, to solve using the formula.

Best Annuity Products of 2024

In this section, you can learn how to use this calculator and the mathematical background that governs it. The calculator also considers how surrender charges could affect your annuity’s value. Present value tells you how much money you would need now to produce a series of payments in the future, assuming a set interest rate. Similarly, the formula for calculating the PV of an annuity due takes into account the fact that payments are made at the beginning rather than the end of each period. FV is a measure of how much a series of regular payments will be worth at some point in the future, given a specified interest rate.

Types of Annuities

Also note that some calculators will reformat to accommodate the screen size as you make the calculator wider or narrower. If the calculator is narrow, columns of entry rows will be converted to a vertical entry form, whereas a wider calculator will display columns of entry rows, and the entry fields will be smaller in size … Note that the Help and Tools panel will be hidden when the calculator is too wide to fit both on the screen.

Benefits of Annuities

If no data record is selected, or you have no entries stored for this calculator, the line will display «None». Calculate the future value of an annuity for either an ordinary annuity, or an annuity due. Note that if you are not sure what future value is, or you wish to calculate future value for a lump sum, please visit the Future Value of Lump Sum Calculator. Once you hit the Calculate button, you’ll see that the total value of your annuity will be $322,759.31 saved for retirement after 25 years of investing.

For example, suppose the owner of a fixed annuity contributes $100,000 and the annuity offers a fixed three percent rate of return. As soon as the payout phase begins, the owner will then be entitled to a $3,000 payment made every year. The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. Please use our Annuity Payout Calculator to determine the income payment phase of an annuity.

We discuss below important issues to be aware of, the different kinds of annuities, and the various formulas you may need to use. Once the contribution (accumulation) phase is completed, they will receive a fixed rate of return on these contributions. With this option, you can set the payment to be made at the end of the period (ordinary annuity) or the beginning of each period (annuity due). Fixed annuities are for the people who look for security the most; however, they will most likely lose buying power because of inflation. In contrast, variable annuities can return much more but have the value fluctuation characteristic.

Moving the slider to the left will bring the instructions and tools panel back into view. I promise not to share your email address with anyone, and will only use it to send the monthly update. If it’s not filled in, please enter the web address of the calculator as displayed in the location field at the top of the browser window (-online-calculator-use.com/____.html). If you have a question about the calculator’s operation, please enter your question, your first name, and a valid email address. All calculators have been tested to work with the latest Chrome, Firefox, and Safari web browsers (all are free to download). I gave up trying to support other web browsers because they seem to thumb their noses at widely accepted standards.

An annuity is a fixed sum of money that will be paid to a person or party in the future at regular intervals. In most cases, an annuity will be paid annually to the intended party for the rest of their life. Calculate the future value of an annuity by entering the payment, term, rate, and type of annuity in the calculator below. Several different factors will determine if investing in an annuity is a good decision for you. An immediate annuity, for example, will begin making payouts right away but will allow for less room for growth. However, in comparison to their fixed counterparts, the interest rate (and therefore the payment) offered by a variable annuity can change over time.

The three lines on the graph represent the expected annuity value as well as the minimum value and the amount of the annuity that is taxable. The annuity is fully taxable income, when you receive an annuity you are actually purchasing an asset and it is a taxable lease renewal letter and extension agreement income. From your perspective, an annuity due would be better since you could earn interest on the first year’s payment for the entire year. Note that my expertise is in creating online calculators, not necessarily in all of the subject areas they cover.

Comments are closed

Sorry, but you cannot leave a comment for this post.